The U.S. fertility market has witnessed significant evolution in recent years, driven by a combination of social, technological, and demographic factors. This market encompasses a range of services, from fertility treatments and assisted reproductive technologies (ART) to fertility preservation. As societal norms shift, and more couples delay starting families, the demand for fertility-related services has surged, creating a robust and dynamic market landscape.

The increasing awareness and acceptance of fertility treatments have contributed to the growth of the market. Advancements in medical technology, such as in vitro fertilization (IVF) and egg freezing, have expanded the options available to individuals and couples facing fertility challenges. Moreover, changing lifestyles, environmental factors, and delayed family planning decisions have led to a rise in the number of people seeking fertility interventions, shaping the landscape of the U.S. fertility market.

Get a Sample: https://www.precedenceresearch.com/sample/3751

Growth Factors:

Several factors are fueling the growth of the U.S. fertility market. Firstly, the rising trend of delaying parenthood as individuals prioritize career goals and personal development has resulted in an increased demand for fertility treatments. Additionally, the growing societal acceptance of non-traditional family structures and the destigmatization of infertility have contributed to a more open dialogue around fertility issues, encouraging more people to seek assistance.

Technological advancements in the field of reproductive medicine play a pivotal role in the market’s growth. The continuous refinement of assisted reproductive technologies, including preimplantation genetic testing (PGT) and gamete cryopreservation, has improved success rates and broadened the scope of fertility treatments. These technological innovations not only enhance the efficacy of fertility procedures but also attract a wider demographic of patients.

U.S. Fertility Market Scope

| Report Coverage |

Details |

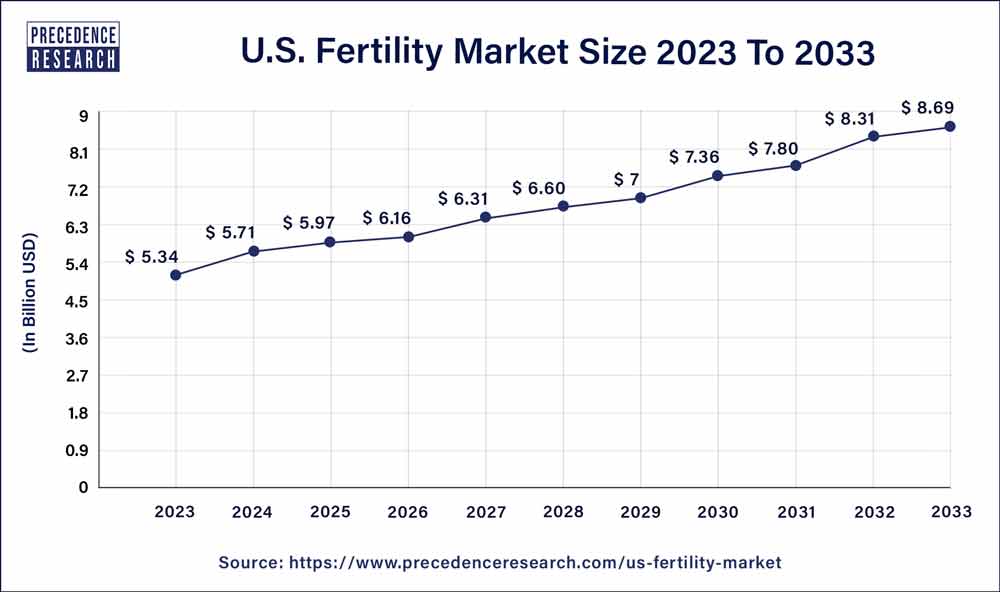

| U.S. Market Size in 2023 |

USD 5.34 Billion |

| U.S. Market Size by 2033 |

USD 8.69 Billion |

| Growth Rate from 2024 to 2033 |

CAGR of 4.78% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Offering and By End User |

Recent Developments

- In January 2024, the creative co-branding venture between Ivy Reproductive, an international center for family-building services, and SMP Pharmacy Solutions, a reproductive specialist pharmacy, aims to improve the patient experience at all 13 of Ivy’s fertility centers.

- In June 2023, Prominent ovarian biology-focused biotechnology company Celmatix Inc. has discovered encouraging early leads in its most recent therapeutic development, which aims to create the first oral FSH receptor (FSHR) agonist medication ever. The cutting-edge experimental product has the power to change infertility therapies completely.

U.S. Fertility Market Dynamics

Drivers:

Several drivers propel the U.S. fertility market forward. One key driver is the increasing prevalence of lifestyle-related factors impacting fertility. Factors such as stress, sedentary lifestyles, and environmental pollutants have contributed to a rise in fertility challenges among both men and women. As awareness of these issues grows, more individuals are seeking fertility treatments to address underlying reproductive health concerns.

Moreover, the growing acceptance and legal support for diverse family structures, including same-sex couples and single parents, have expanded the potential customer base for fertility clinics. This inclusivity has not only boosted demand for fertility services but has also prompted fertility clinics to tailor their offerings to meet the unique needs of various patient demographics.

Restraints:

Despite the overall growth, the U.S. fertility market faces certain challenges and restraints. One notable restraint is the high cost associated with fertility treatments. Many individuals and couples find these treatments financially burdensome, and the lack of comprehensive insurance coverage for fertility services further compounds the issue. As a result, a significant portion of the population may be unable to access or afford fertility interventions.

Another restraint is the emotional toll that fertility treatments can take on individuals and couples. The uncertainty of success, coupled with the physical and emotional demands of procedures like IVF, can lead to stress and psychological strain. Addressing these emotional challenges is crucial for both the well-being of patients and the long-term success of fertility clinics.

Opportunity:

The U.S. fertility market presents ample opportunities for growth and innovation. One notable opportunity lies in expanding awareness and education about fertility preservation. With more individuals opting to delay family planning, educating the public about the options available for preserving fertility, such as egg freezing, can tap into a previously underserved market segment.

Additionally, collaborations between fertility clinics and insurance providers could create opportunities to make fertility treatments more accessible. By advocating for improved insurance coverage and developing more affordable payment plans, the industry can potentially overcome the financial barriers that currently limit access to fertility services.

Innovation in telemedicine and digital health presents another avenue for growth. The integration of virtual consultations, remote monitoring, and digital platforms can enhance the accessibility and convenience of fertility services, reaching a broader audience and potentially reducing some of the emotional burdens associated with in-person clinic visits.

Read Also: Pharmaceutical Contract Manufacturing Market Size, Growth, Share, Report 2033