- North America contributed 36% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By service, the pharmaceutical manufacturing services segment has held the largest market share of 33% in 2023.

- By service, the drug development services segment is anticipated to grow at a remarkable CAGR of 8.9% between 2024 and 2033.

- By end-user, the big pharmaceutical companies segment generated over 42% of revenue share in 2023.

- By end-user, the small & mid-sized pharmaceutical companies segment is expected to expand at the fastest CAGR over the projected period.

Pharmaceutical Contract Manufacturing Market: A Comprehensive Analysis

The pharmaceutical contract manufacturing market has witnessed substantial growth in recent years, driven by various factors that have reshaped the pharmaceutical industry landscape. This sector plays a pivotal role in the drug development and production process, allowing pharmaceutical companies to outsource manufacturing activities to specialized firms. This overview delves into the key facets of the pharmaceutical contract manufacturing market, exploring its growth trajectory, drivers, restraints, and opportunities.

Overview:

The pharmaceutical contract manufacturing market is a dynamic and evolving segment of the pharmaceutical industry, characterized by the outsourcing of various stages of drug production to third-party manufacturers. These manufacturers, often referred to as Contract Development and Manufacturing Organizations (CDMOs), provide services ranging from drug formulation and development to manufacturing, packaging, and distribution. The market has experienced notable expansion as pharmaceutical companies increasingly seek to enhance efficiency, reduce costs, and focus on core competencies, driving the demand for outsourcing services.

Get a Sample: https://www.precedenceresearch.com/sample/3750

Growth Factors:

Several factors contribute to the growth of the pharmaceutical contract manufacturing market. Firstly, the rising complexity of drug development processes and the need for specialized expertise drive pharmaceutical companies to collaborate with CDMOs possessing advanced technologies and capabilities. Additionally, the growing trend of biopharmaceuticals and the increasing number of new and innovative drugs entering the market fuel the demand for contract manufacturing services. The globalization of pharmaceutical supply chains also plays a role, as companies seek to diversify their manufacturing locations for risk mitigation and cost optimization.

Moreover, the accelerated pace of research and development in the pharmaceutical sector contributes to the expansion of the contract manufacturing market. CDMOs offer a quick and flexible solution for scaling up production during different stages of drug development, enabling pharmaceutical companies to bring products to market more efficiently. This adaptability aligns with the industry’s need for agile manufacturing solutions, driving the growth of contract manufacturing partnerships.

Pharmaceutical Contract Manufacturing Market Scope

| Report Coverage | Details |

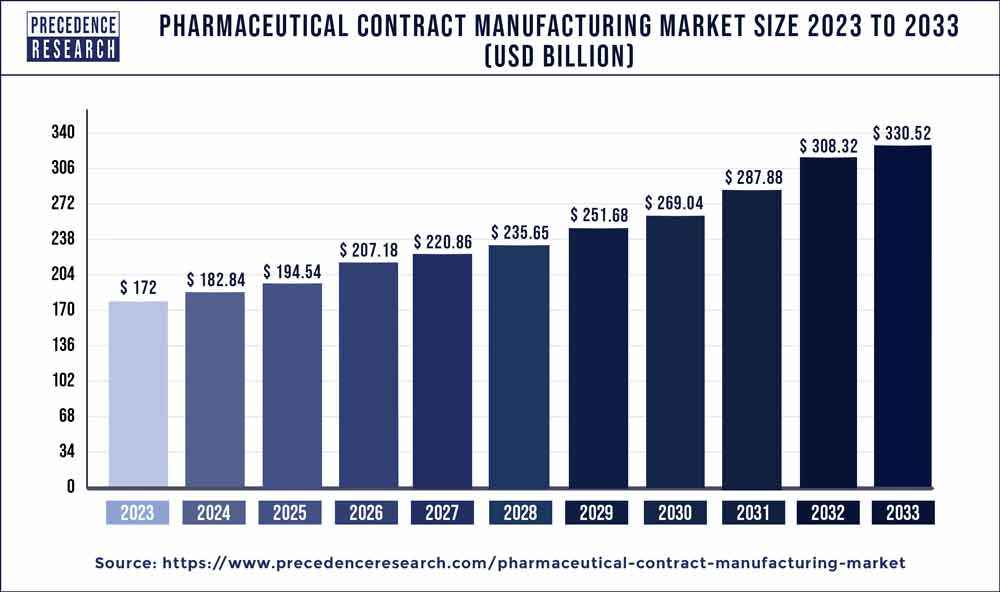

| Growth Rate from 2024 to 2033 | CAGR of 6.80% |

| Global Market Size in 2023 | USD 172 Billion |

| Global Market Size by 2033 | USD 330.52 Billion |

| U.S. Market Size in 2023 | USD 43.34 Billion |

| U.S. Market Size by 2033 | USD 84.07 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In September 2022, Lonza Group entered into a partnership with Touchlight, a biotechnology company, to enhance its comprehensive mRNA manufacturing capabilities by incorporating an additional source of DNA.

- In February 2022, Thermo Fisher Scientific collaborated with Moderna, Inc. to facilitate the large-scale production of Moderna’s COVID-19 vaccine, Spikevax, and other experimental mRNA therapies in its development pipeline.

- In January 2023, Catalent played a crucial role in supporting the manufacturing process for Sarepta’s advanced gene therapy candidate, delandistrogene moxeparvovec (SRP-9001), designed to address Duchenne muscular dystrophy.

Pharmaceutical Contract Manufacturing Market Dynamics

Drivers:

The pharmaceutical contract manufacturing market is driven by several key factors. One significant driver is the increasing cost pressures on pharmaceutical companies to bring new drugs to market. Outsourcing manufacturing activities allows these companies to reduce capital expenditures, enhance operational efficiency, and access specialized manufacturing capabilities without the need for significant upfront investments. Additionally, the growing focus on core competencies compels pharmaceutical firms to leverage external expertise for manufacturing, freeing up resources for research, development, and commercialization.

Furthermore, the demand for flexible and scalable manufacturing solutions is a driving force behind the market’s growth. Contract manufacturing enables pharmaceutical companies to adapt quickly to changing market dynamics, fluctuations in demand, and evolving regulatory requirements. This flexibility is crucial in an industry where rapid innovation and dynamic market conditions necessitate agile manufacturing capabilities.

Restraints:

While the pharmaceutical contract manufacturing market experiences robust growth, it is not without challenges and restraints. One notable constraint is the potential loss of control over the manufacturing process. Outsourcing production to third-party manufacturers introduces complexities in quality control, supply chain management, and intellectual property protection. Pharmaceutical companies must carefully navigate these challenges to ensure the reliability and compliance of their outsourced manufacturing partners.

Another restraint is the regulatory scrutiny associated with the pharmaceutical industry. Contract manufacturing involves adherence to stringent regulatory requirements imposed by various health authorities. Ensuring compliance with these regulations poses a challenge for both pharmaceutical companies and CDMOs, as non-compliance can lead to delays in product approval and market entry.

Opportunities:

The pharmaceutical contract manufacturing market presents numerous opportunities for growth and innovation. The increasing prevalence of personalized medicine and the development of niche and orphan drugs open new avenues for contract manufacturing services. CDMOs that specialize in the production of small-batch, high-value drugs can capitalize on this trend, providing tailored manufacturing solutions to meet the unique requirements of these therapies.

Moreover, the expansion of contract manufacturing into emerging markets represents a significant opportunity. As pharmaceutical companies seek to diversify their manufacturing locations and tap into the growing demand for healthcare products in regions like Asia-Pacific and Latin America, CDMOs can establish strategic partnerships and facilities in these markets. This geographical diversification not only provides cost advantages but also aligns with the global nature of pharmaceutical supply chains.

Read Also: U.S. Insulation Market Size to Rise USD 19.96 Bn by 2033

Pharmaceutical Contract Manufacturing Market Companies

- Lonza Group

- Catalent, Inc.

- Patheon (Now part of Thermo Fisher Scientific)

- Recipharm AB

- Boehringer Ingelheim

- Dr. Reddy’s Laboratories

- Jubilant Life Sciences

- Fareva

- Vetter Pharma

- Evonik Industries

- WuXi AppTec

- Pfizer CentreOne

- Almac Group

- AbbVie Contract Manufacturing

- Samsung Biologics

Segments Covered in the Report

By Service

- Pharmaceutical Manufacturing Services

- Pharmaceutical API Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

- Drug Development Services

- Biologic Manufacturing Services

- Biologic API Manufacturing Services

- Biologic FDF Manufacturing Services

By End User

- Big Pharmaceutical Companies

- Small & Mid-Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other End Users (Academic Institutes, Small CDMOs, and CROs)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/