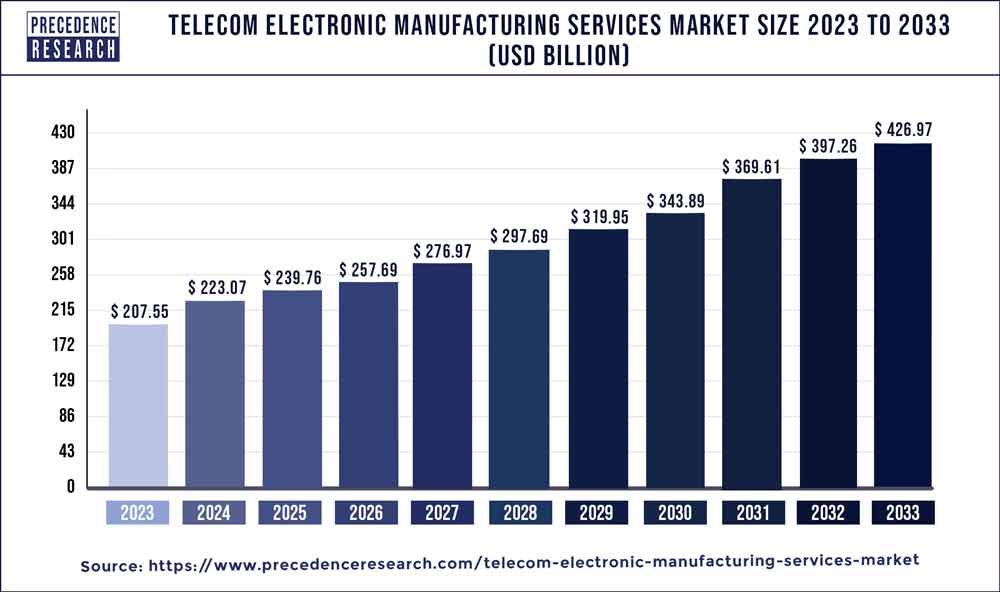

The global telecom electronic manufacturing services market size was valued at USD 207.55 billion in 2023 and is expected to reach around USD 426.97 billion by 2033 with a CAGR of 7.48% from 2024 to 2033.

Key Points

- Asia-Pacific contributed the largest share of the market in 2023.

- North America is estimated to expand at the fastest CAGR between 2024 and 2033.

- By services, the electronic manufacturing segment dominated the market with the largest share in 2023.

- By services, the electronic design & engineering segment is anticipated to grow at a remarkable CAGR during the forecast period.

The Telecom Electronic Manufacturing Services (EMS) market is a critical component of the telecommunications industry, providing a range of services including design, manufacturing, testing, and distribution of electronic components and devices used in telecommunications equipment. These services encompass a wide array of products such as network infrastructure equipment, mobile devices, and communication systems. The Telecom EMS market plays a pivotal role in meeting the demands of rapidly evolving telecommunications technologies, ensuring the timely delivery of high-quality products to meet consumer needs and industry standards.

Get a Sample: https://www.precedenceresearch.com/sample/3861

Growth Factors

Several factors are driving the growth of the Telecom EMS market. Firstly, the increasing adoption of advanced telecommunications technologies such as 5G networks, Internet of Things (IoT) devices, and cloud-based services is driving the demand for specialized electronic components and equipment. This surge in demand necessitates the expertise and resources offered by EMS providers to efficiently design, manufacture, and deliver these complex products.

Moreover, the globalization of telecommunications markets has led to the decentralization of manufacturing operations, with many telecom companies outsourcing production to EMS providers to capitalize on cost advantages, access specialized expertise, and streamline supply chain management. This trend is further fueling the growth of the Telecom EMS market, as providers offer scalable and flexible manufacturing solutions tailored to the specific needs of their clients.

Additionally, the increasing focus on product innovation and time-to-market pressures are prompting telecom companies to collaborate with EMS providers to accelerate product development cycles and gain a competitive edge. EMS providers offer value-added services such as design optimization, supply chain management, and aftermarket support, enabling telecom companies to bring innovative products to market faster and more cost-effectively.

Telecom Electronic Manufacturing Services Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.48% |

| Global Market Size in 2023 | USD 207.55 Billion |

| Global Market Size by 2033 | USD 426.97 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Services |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Telecom Electronic Manufacturing Services Market Dynamics

Drivers:

Several drivers are propelling the growth of the Telecom EMS market. One significant driver is the rapid proliferation of mobile devices and the expansion of wireless networks worldwide. With the advent of 5G technology and the growing demand for high-speed data connectivity, telecom companies are investing heavily in infrastructure upgrades and network expansion, driving the demand for electronic components and equipment.

Furthermore, the increasing complexity and miniaturization of electronic devices are driving the need for specialized manufacturing expertise and advanced production capabilities. EMS providers play a crucial role in meeting these requirements by offering advanced manufacturing processes, such as surface mount technology (SMT), printed circuit board (PCB) assembly, and precision machining, to produce high-performance telecom equipment.

Another key driver is the growing emphasis on cost optimization and operational efficiency among telecom companies. Outsourcing manufacturing operations to EMS providers allows telecom companies to reduce capital expenditures, minimize production costs, and focus on their core competencies such as research and development and marketing. This strategic shift towards outsourcing is driving the demand for Telecom EMS services, particularly among small and medium-sized telecom companies looking to gain a competitive advantage.

Opportunities:

The Telecom EMS market presents several opportunities for growth and expansion. One significant opportunity lies in the deployment of 5G networks and the development of associated infrastructure and devices. As telecom companies race to roll out 5G services globally, there is a growing need for EMS providers to support the manufacturing and assembly of 5G equipment, including base stations, antennas, routers, and small cells.

Additionally, the increasing adoption of IoT devices across various industry verticals, such as healthcare, automotive, and smart cities, presents a significant growth opportunity for Telecom EMS providers. These devices require specialized electronic components and customized manufacturing solutions to meet the unique requirements of IoT applications, creating a demand for EMS services tailored to IoT device manufacturing.

Furthermore, the emergence of new technologies such as artificial intelligence (AI), machine learning, and augmented reality (AR) in the telecommunications sector presents opportunities for EMS providers to offer value-added services such as design optimization, predictive maintenance, and remote diagnostics. By leveraging these technologies, EMS providers can enhance their offerings and differentiate themselves in the highly competitive Telecom EMS market.

Restraints:

Despite the favorable market conditions, the Telecom EMS market faces several restraints that may hinder its growth. One significant restraint is the increasing complexity and regulatory compliance requirements associated with telecommunications equipment manufacturing. EMS providers must adhere to stringent quality standards, industry certifications, and regulatory requirements imposed by governments and regulatory bodies, which can increase operational costs and complexity.

Moreover, geopolitical factors such as trade tensions, tariffs, and export controls can disrupt global supply chains and impact the operations of Telecom EMS providers. Uncertainties surrounding international trade agreements and political instability in key manufacturing regions can create challenges for EMS providers in sourcing components, managing logistics, and mitigating supply chain risks.

Additionally, the ongoing COVID-19 pandemic has presented unprecedented challenges for the Telecom EMS market, including supply chain disruptions, labor shortages, and reduced demand for telecom equipment. While the pandemic has accelerated digital transformation and the adoption of remote communication technologies, it has also disrupted manufacturing operations and created economic uncertainty, which may impact the growth prospects of the Telecom EMS market in the short term.

Read Also: Smart Infrastructure Market Size to Rise USD 2,414.28 Bn By 2033

Recent Developments

- In August of 2022, Celestica Inc., a company specializing in design, manufacturing, and supply chain solutions for innovative companies, unveiled a range of new storage solutions. Notable among these are the Athena G2, a state-of-the-art 2U rackmount NVMe storage array; the Nebula G2, an all-flash storage expansion featuring PCIe 4.0 NVMe SSDs; and the Titan G2, an advanced 4U dense storage array. These cutting-edge products provide unmatched flexibility and customizable options to meet the rigorous demands of contemporary applications, whether deployed on-premises or in public clouds.

- In June 2022, Flex announced its strategic initiative to bolster its presence in the automotive industry by expanding its operations in Jalisco, Mexico. The forthcoming project involves the construction of a cutting-edge facility spanning 145,000 square feet. This state-of-the-art facility is poised to become a pivotal manufacturing hub in the region, with a focus on producing advanced electronic components to propel the advancement of electric and autonomous vehicles.

- In March 2021, PleXUs, a leader in complex product design, manufacturing, supply chain, and aftermarket services, initiated the construction of a cutting-edge manufacturing facility in Bangkok, Thailand. Covering an impressive 400,000 square feet, this new facility comprises two production and warehousing levels along with four office space levels. Demonstrating a commitment to upholding environmental, social, and governance (ESG) best practices, PleXUs has seamlessly integrated various energy-efficient and green building initiatives into the facility’s design.

Competitive Landscape:

The Telecom EMS market is highly competitive, with a diverse ecosystem of global and regional players offering a wide range of services and solutions. Major players in the market include Foxconn Technology Group, Flex Ltd., Jabil Inc., Celestica Inc., Benchmark Electronics Inc., and Sanmina Corporation, among others. These companies provide end-to-end EMS solutions encompassing design, engineering, manufacturing, testing, and logistics services to telecom companies worldwide.

To remain competitive in the Telecom EMS market, players are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and investments in research and development to expand their service offerings, enhance their manufacturing capabilities, and penetrate new geographic markets. Additionally, players are leveraging technologies such as automation, robotics, and artificial intelligence to optimize production processes, improve product quality, and drive operational efficiencies.

Telecom Electronic Manufacturing Services Market Companies

- Foxconn Technology Group

- Jabil Inc.

- Flex Ltd.

- Celestica Inc.

- Benchmark Electronics, Inc.

- Sanmina Corporation

- Plexus Corp.

- Kimball Electronics, Inc.

- Wistron Corporation

- Universal Scientific Industrial Co., Ltd. (USI)

- Zollner Elektronik AG

- Venture Corporation Limited

- SIIX Corporation

- Elcoteq SE

- SMTC Corporation

Segments Covered in the Report:

By Services

- Electronic Design & Engineering

- Electronics Assembly

- Electronic Manufacturing

- Supply Chain Management

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/