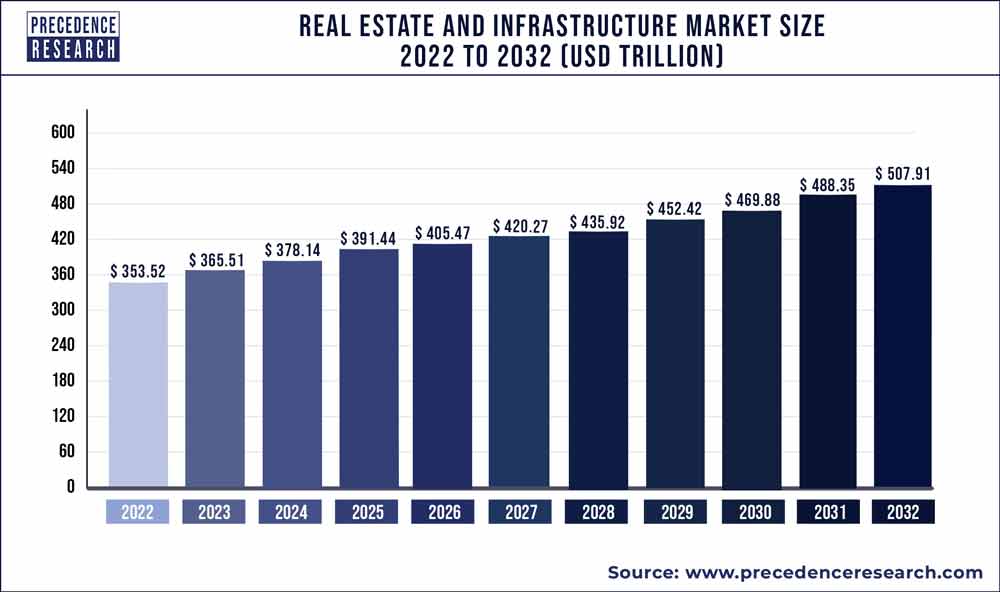

The real estate and infrastructure market size is poised to grow by $ 507.91 trillion by 2032 from $ 365.51 trillion in 2023, exhibiting a CAGR of 3.70% during the forecast period 2023-2032.

Key Takeaways

- By property type, the residential segment dominated the real estate market with a market size of USD 285.28 trillion in 2023 and is likely to reach USD 396.48 trillion with a CAGR of 3.7% in 2032.

- By property type, the commercial real estate market is expected to grow with a market value of USD 26.84 trillion in 2023 and is anticipated to reach USD 34.78 trillion with a CAGR of 2.9% in 2032.

- By business type, the buying segment dominated the real estate market with a market size of USD 198.23 trillion in 2023 and is likely to reach USD 264.12 trillion with a CAGR of 3.2% in 2032.

- By business type, the rental segment is expected to grow with a market value of USD 167.28 trillion in 2023 and is anticipated to reach USD 243.80 trillion with a CAGR of 2.9% in 2032.

- By region, North America dominated the real estate and infrastructure market with the largest market size of USD 107.90 trillion in 2023 and forecasted to reach USD 142.16 trillion with a CAGR of 3.1% in 2032. The Europe segment is expected to increase its market size to USD 94.87 trillion in 2023 and is predicted to reach USD 135.45 trillion with a CAGR of 4.0% in 2032.

The Real Estate and Infrastructure market is a dynamic and integral sector that plays a pivotal role in shaping the economic landscape of a region. It encompasses a wide spectrum of activities, ranging from residential and commercial real estate development to the construction of essential infrastructure such as roads, bridges, and utilities. This market is driven by various factors, including urbanization, population growth, economic trends, and government policies. The intertwining of real estate and infrastructure creates a robust ecosystem that not only addresses housing needs but also fosters overall economic development.

Get a Sample: https://www.precedenceresearch.com/sample/3566

Growth Factors:

- Urbanization and Population Growth: The global trend towards urbanization and the continuous rise in population contribute significantly to the growth of the Real Estate and Infrastructure market. As more people move to urban areas, there is an increased demand for residential spaces, commercial establishments, and improved infrastructure to support the burgeoning population.

- Economic Development: Economic prosperity and development are closely linked to the expansion of the real estate and infrastructure sector. Growing economies often witness increased investments in real estate projects and infrastructure development, further fueling the demand for construction and related services.

- Government Initiatives and Policies: Government policies and initiatives play a crucial role in shaping the trajectory of the Real Estate and Infrastructure market. Supportive policies, incentives, and regulatory frameworks can encourage private sector participation, stimulate investments, and drive sustainable development in the sector.

- Technological Advancements: The integration of technology in real estate and infrastructure development has become a significant growth factor. Innovations such as smart cities, sustainable construction practices, and the adoption of digital tools enhance efficiency, reduce costs, and contribute to the overall advancement of the market.

- Environmental Sustainability: Increasing awareness of environmental issues has led to a growing emphasis on sustainable and eco-friendly practices in real estate and infrastructure. Green building initiatives, renewable energy integration, and environmentally conscious designs are becoming key drivers of growth, aligning the sector with global sustainability goals.

Real Estate and Infrastructure Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 365.51 Trillion |

| Market Size by 2032 | USD 507.91 Trillion |

| Growth Rate from 2023 to 2032 | CAGR of 3.70% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Property Type, By Commercial Property Type, By Specialized Property Type, By Infrastructure Property Type, and By Business Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Industrial Catalysts Market Size To Worth USD 31.49 Bn By 2032

By Property Type: The real estate market is diverse, encompassing various property types to meet the varied needs of investors and homeowners. Residential properties, including single-family homes, condominiums, and apartments, are fundamental components. Commercial properties, such as office buildings and retail spaces, cater to businesses. Industrial properties, like warehouses and manufacturing facilities, serve as hubs for production and storage. Lastly, land represents a crucial category for development and investment potential.

By Commercial Property Type: Commercial real estate is further categorized into various types to address specific business requirements. Office spaces provide workplaces for professionals and corporations. Retail properties, such as shopping malls and storefronts, accommodate businesses selling goods and services. Industrial real estate encompasses facilities for manufacturing, distribution, and storage. Hospitality properties, like hotels and resorts, focus on lodging and entertainment for travelers and tourists.

By Specialized Property Type: Specialized properties cater to unique needs and niche markets. This category includes healthcare facilities like hospitals and clinics, catering specifically to the medical sector. Educational properties, such as schools and universities, are designed for academic purposes. Senior living facilities address the housing and care needs of the elderly. Specialized properties highlight the adaptability of real estate to various societal needs.

By Infrastructure Property Type: Infrastructure plays a crucial role in supporting communities and economies. Transportation infrastructure involves properties like airports, railways, and highways, facilitating the movement of people and goods. Utilities infrastructure includes energy production facilities, water treatment plants, and telecommunication networks. Social infrastructure encompasses properties like schools and hospitals, contributing to the overall well-being of a community.

By Business Type: The real estate market is closely linked to different business sectors. Corporate real estate involves properties used by businesses for their operations, including offices and manufacturing facilities. Retail businesses rely on properties that provide a platform for selling products or services directly to consumers. Industrial businesses require properties for production, storage, and distribution. The diversity in business types contributes to the dynamism of the real estate market.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Real Estate and Infrastructure Market Players

- Simon Property Group

- CBRE Group

- Cushman and Wakefield PLC

- JLL

- Homie Real Estate

- Houwzer

- American Tower

- RE/Max

- Equity Residential

- Vornado Realty

- BrazilOasis

Segments Covered in the Report:

By Property Type

- Residential

- Commercial

- Industrial

- Specialized

- Infrastructure

By Commercial Property Type

- Offices

- Hospitals

- Retails

- Others

By Specialized Property Type

- Healthcare

- Education

- Leisure

By Infrastructure Property Type

- Energy

- Telecom

- Utilities

- Transportation

By Business Type

- Buy

- Rental

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Real Estate and Infrastructure Market

5.1. COVID-19 Landscape: Real Estate and Infrastructure Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Real Estate and Infrastructure Market, By Property Type

8.1. Real Estate and Infrastructure Market, by Property Type, 2023-2032

8.1.1. Residential

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Commercial

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Industrial

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Specialized

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Infrastructure

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Real Estate and Infrastructure Market, By Commercial Property Type

9.1. Real Estate and Infrastructure Market, by Commercial Property Type, 2023-2032

9.1.1. Offices

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Hospitals

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Retails

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Real Estate and Infrastructure Market, By Specialized Property Type

10.1. Real Estate and Infrastructure Market, by Specialized Property Type, 2023-2032

10.1.1. Healthcare

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Education

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Leisure

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Real Estate and Infrastructure Market, By Infrastructure Property Type

11.1. Real Estate and Infrastructure Market, by Infrastructure Property Type, 2023-2032

11.1.1. Energy

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Telecom

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Utilities

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Real Estate and Infrastructure Market, By Business Type

12.1. Real Estate and Infrastructure Market, by Business Type, 2023-2032

12.1.1. Buy

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Rental

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Real Estate and Infrastructure Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.1.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.1.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.1.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.1.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.1.6.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.1.7. Rest of North America

13.1.7.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.1.7.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.1.7.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.1.7.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.1.7.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.7. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.8. Market Revenue and Forecast, by Business Type (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.10. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.11. Market Revenue and Forecast, by Business Type (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.13. Market Revenue and Forecast, by Business Type (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.2.15. Market Revenue and Forecast, by Business Type (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.7. Market Revenue and Forecast, by Business Type (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.9. Market Revenue and Forecast, by Business Type (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.10.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.3.11.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.7. Market Revenue and Forecast, by Business Type (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.9. Market Revenue and Forecast, by Business Type (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.10.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.4.11.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.5.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.5.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.5.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.5.5. Market Revenue and Forecast, by Business Type (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.5.7. Market Revenue and Forecast, by Business Type (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Property Type (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Commercial Property Type (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Specialized Property Type (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Infrastructure Property Type (2020-2032)

13.5.8.5. Market Revenue and Forecast, by Business Type (2020-2032)

Chapter 14. Company Profiles

14.1. Simon Property Group

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. CBRE Group

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Cushman and Wakefield PLC

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. JLL

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Homie Real Estate

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Houwzer

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. American Tower

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. RE/Max

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Equity Residential

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Vornado Realty

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/