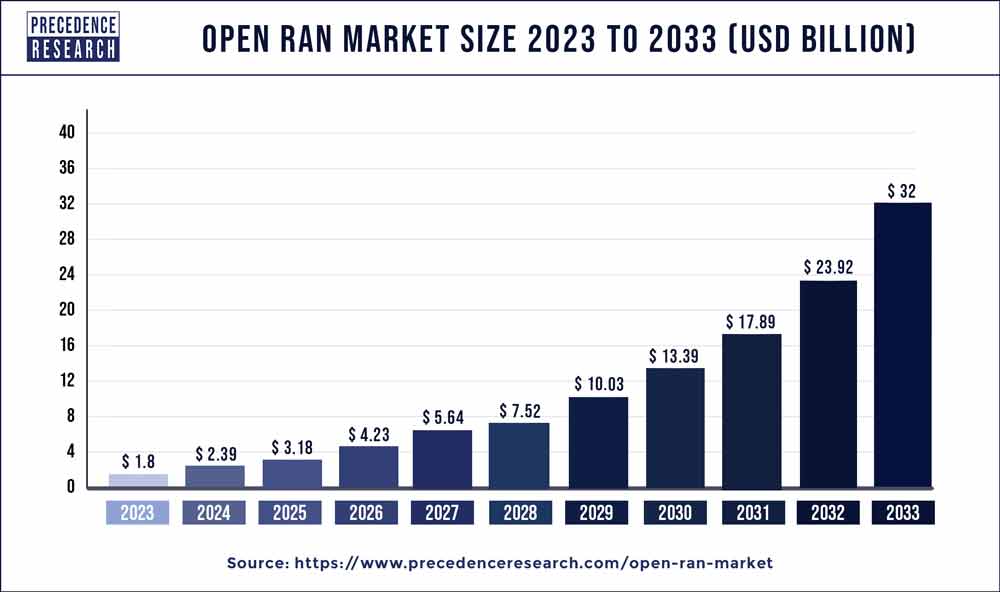

The global open RAN market size is predicted to be worth around USD 32 billion by 2033, poised to grow at a CAGR of 33.40% from 2024 to 2033.

Key Points

- North America contributed 45% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By component, the hardware segment has held the largest market share of 49% in 2023.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 35.3% between 2024 and 2033.

- By unit, the radio unit segment generated over 39% of the market share in 2023.

- By unit, the distributed unit segment is expected to expand at the fastest CAGR over the projected period.

- By deployment, the hybrid cloud segment generated 50% of the market share in 2023.

- By deployment, the private cloud segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The Open RAN (Radio Access Network) market is witnessing significant growth and innovation as the telecommunications industry evolves towards more flexible and cost-effective network infrastructure solutions. Open RAN refers to a disaggregated approach to building RANs, enabling operators to use network equipment from multiple vendors that adhere to open and interoperable standards. This departure from traditional monolithic vendor-specific RAN solutions has sparked considerable interest among operators seeking to reduce costs, increase flexibility, and accelerate innovation in their networks.

Growth Factors

Several key factors are driving the growth of the Open RAN market. Firstly, the demand for more agile and scalable network infrastructure is on the rise, particularly with the advent of 5G and the increasing data traffic. Open RAN offers operators the flexibility to deploy and manage their networks more efficiently, enabling them to adapt to changing market demands and technology advancements. Additionally, the potential cost savings associated with Open RAN deployment are significant, as operators can leverage a wider range of vendors and commoditized hardware components, thereby reducing dependency on expensive proprietary solutions.

Moreover, regulatory initiatives aimed at promoting competition and innovation in the telecommunications sector are further fueling the adoption of Open RAN. Governments and regulatory bodies around the world are increasingly advocating for open and interoperable standards to facilitate the deployment of advanced telecommunications infrastructure. This push towards openness and standardization is creating favorable conditions for the growth of the Open RAN market, as operators seek to comply with regulatory requirements while unlocking new opportunities for innovation and competition.

Furthermore, the increasing focus on sustainability and environmental responsibility is driving interest in Open RAN solutions. By enabling operators to deploy more energy-efficient and environmentally friendly network infrastructure, Open RAN contributes to reducing the carbon footprint of telecommunications networks. This alignment with broader sustainability goals is likely to drive demand for Open RAN solutions in the coming years, particularly as environmental concerns become more prominent on the global agenda.

Open RAN Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 33.40% |

| Global Market Size in 2023 | USD 1.8 Billion |

| Global Market Size by 2033 | USD 32 Billion |

| U.S. Market Size in 2023 | USD 0.56 Billion |

| U.S. Market Size by 2033 | USD 10.16 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Unit, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In June of 2022, the collaboration between Ericsson and Orange Egypt reached a milestone as they successfully finalized the consolidation, upgrade, and modernization of Orange Egypt’s mediation system. This advancement empowered Ericsson to efficiently filter out irrelevant data and transform it into the required format for data consumers.

- In May 2022, Huawei and Emirates formalized an agreement that encompasses collaborative marketing efforts on joint projects and promotional activities. The primary focus of this collaboration is to extend their influence in each other’s domestic markets.

- February 2022 witnessed a joint initiative by Nokia and AT&T, as they worked together to develop an RIC (RAN Intelligent Controller) software platform. Successful trials were conducted with external applications, referred to as “xApps,” at the edge of AT&T’s operational 5G mmWave network on an Open Cloud Platform. Nokia and AT&T are committed to enhancing the 5G uplink through the implementation of distributed massive MIMO technology.

Open RAN Market Dynamics

Drivers:

Several drivers are propelling the adoption of Open RAN in the telecommunications industry. One of the primary drivers is the desire for vendor diversification and reduced vendor lock-in. Traditional RAN deployments often involve long-term contracts with a single vendor, limiting operators’ ability to switch suppliers or negotiate better terms. With Open RAN, operators have the flexibility to choose from a wider range of vendors and mix and match components according to their specific requirements, thereby reducing dependency on any single vendor.

Additionally, the promise of increased innovation and faster time-to-market is driving interest in Open RAN among operators. By embracing open standards and fostering a more collaborative ecosystem, Open RAN enables operators to tap into a broader pool of technology providers and developers, accelerating the pace of innovation in the industry. This ability to quickly adopt and integrate new technologies and features is critical in the highly competitive telecommunications market, where operators are constantly seeking ways to differentiate their services and attract customers.

Furthermore, the potential cost savings associated with Open RAN deployment are a significant driver for operators looking to optimize their network investments. By leveraging standardized hardware components and software-defined networking principles, Open RAN offers operators greater cost efficiency compared to traditional RAN solutions. This cost advantage is particularly attractive in markets where operators are under pressure to reduce capital and operational expenditures while expanding and enhancing their network capabilities.

Restraints:

Despite the promising growth prospects, the Open RAN market faces several challenges and restraints that could hinder its widespread adoption. One of the primary challenges is the complexity of integration and interoperability testing. As operators deploy Open RAN solutions comprising equipment from multiple vendors, ensuring seamless interoperability and performance across the entire network becomes increasingly complex. Integrating diverse hardware and software components, conducting rigorous testing, and troubleshooting interoperability issues require substantial resources and expertise, posing a barrier to adoption for some operators.

Moreover, concerns related to security and reliability remain a significant restraint for Open RAN deployments. As networks become more open and disaggregated, the attack surface for malicious actors increases, raising concerns about the security of critical infrastructure and sensitive data. Ensuring robust security measures and implementing effective threat detection and mitigation mechanisms are essential for mitigating security risks in Open RAN environments. Similarly, maintaining high levels of network reliability and availability is crucial for meeting the stringent performance requirements of telecommunications services, necessitating careful planning and implementation of redundancy and failover mechanisms in Open RAN deployments.

Furthermore, the lack of mature ecosystem and vendor support poses a challenge for operators considering Open RAN adoption. While the Open RAN concept is gaining traction, the ecosystem of vendors and technology providers offering interoperable solutions is still relatively nascent compared to traditional RAN vendors. This limited vendor ecosystem may restrict operators’ choices and increase the complexity of sourcing and integrating components for their Open RAN deployments. Additionally, the availability of skilled personnel capable of designing, deploying, and managing Open RAN networks may be limited, further complicating the adoption process for some operators.

Opportunities:

Despite the challenges, the Open RAN market presents significant opportunities for operators, vendors, and technology providers alike. One of the key opportunities lies in the potential for innovation and differentiation. By embracing open standards and fostering collaboration within the ecosystem, operators can leverage a diverse range of technologies and solutions to differentiate their services and create unique value propositions for their customers. Whether it’s delivering enhanced network performance, innovative service offerings, or personalized customer experiences, Open RAN provides operators with the flexibility and agility to innovate and differentiate in a competitive market landscape.

Moreover, the Open RAN market offers opportunities for cost optimization and efficiency improvements. By leveraging commoditized hardware components and software-defined networking principles, operators can achieve cost savings and operational efficiencies compared to traditional RAN solutions. This cost advantage is particularly significant for operators operating in competitive or cost-constrained markets, where optimizing network investments is critical for maintaining profitability and competitiveness.

Furthermore, the growing emphasis on sustainability and environmental responsibility presents an opportunity for Open RAN deployments. By enabling operators to deploy more energy-efficient and environmentally friendly network infrastructure, Open RAN contributes to reducing the carbon footprint of telecommunications networks. This alignment with broader sustainability goals not only enhances operators’ corporate social responsibility credentials but also provides a compelling value proposition for environmentally conscious customers and stakeholders.

Read Also: U.S. Vehicle-to-Grid Technology Market Size, Share, Growth, Report By 2033

Open RAN Market Companies

- Mavenir

- Altiostar

- Parallel Wireless

- Radisys

- NEC Corporation

- Qualcomm

- Samsung

- Airspan Networks

- Fujitsu

- NEC Corporation

- Cisco

- Nokia

- Intel Corporation

- ZTE Corporation

- VMware

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Unit

- Radio Unit

- Distributed Unit

- Centralized Unit

By Deployment

- Private

- Hybrid Cloud

- Public Cloud

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/