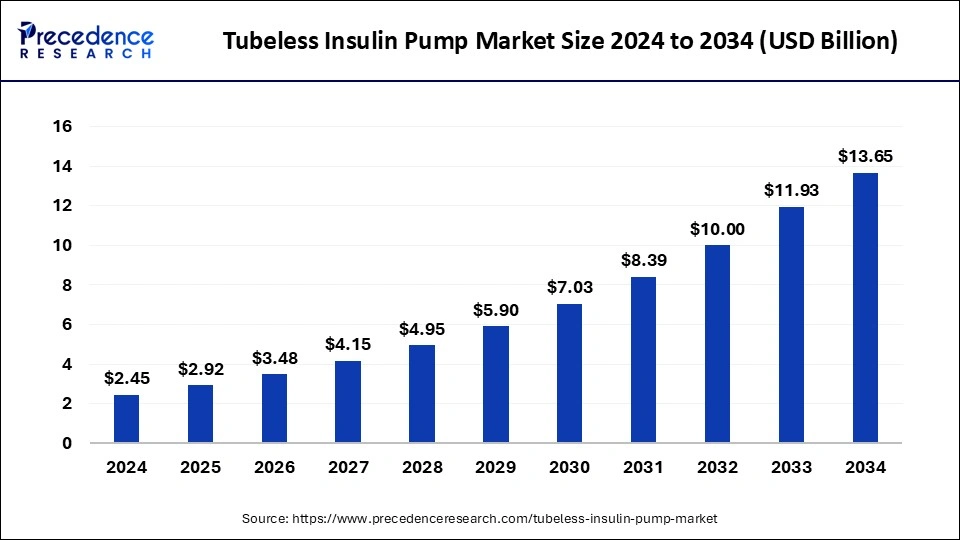

The global tubeless insulin pump market size accounted for USD 2.05 billion in 2023 and is anticipated to hit around USD 11.93 billion by 2033, growing at a CAGR of 19.25% from 2024 to 2033.

Key Points

- North America held the largest market share of 55% in 2023.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By type, the insulin patch pump segment accounted for the dominating share in 2023. The segment is observed to continue growth at a significant rate in the upcoming period.

- By component, the pod or patch segment held the largest share of the market in 2023.

- By end users, the hospitals segment held the largest share of the market in 2023.

The tubeless insulin pump market has witnessed significant growth in recent years, driven by the increasing prevalence of diabetes worldwide and the demand for advanced insulin delivery systems. Tubeless insulin pumps offer convenience and flexibility to diabetic patients by eliminating the need for external tubing, thereby enhancing their quality of life. These pumps deliver insulin through a small cannula inserted under the skin, providing continuous insulin infusion with precise dosing capabilities. As technology continues to advance, tubeless insulin pumps are becoming increasingly sophisticated, offering features such as automated insulin delivery and integration with continuous glucose monitoring systems.

Get a Sample: https://www.precedenceresearch.com/sample/3944

Growth Factors:

Several factors contribute to the growth of the tubeless insulin pump market. One key factor is the rising incidence of diabetes globally, fueled by sedentary lifestyles, unhealthy dietary habits, and an aging population. As the prevalence of diabetes increases, there is a growing need for effective insulin delivery solutions that can help patients manage their condition more conveniently and efficiently. Tubeless insulin pumps address this need by offering discreet and wearable insulin delivery options, enhancing patient compliance and treatment adherence.

Additionally, technological advancements in tubeless insulin pump design and functionality drive market growth. Manufacturers are continuously innovating to improve pump reliability, user interface, and integration with other diabetes management technologies. For example, newer models of tubeless insulin pumps feature smaller form factors, longer battery life, and wireless connectivity for data monitoring and remote control. These innovations enhance the user experience and contribute to the adoption of tubeless insulin pumps among diabetic patients.

Moreover, increasing awareness about the benefits of insulin pump therapy among healthcare professionals and patients is boosting market growth. Clinical studies and real-world evidence demonstrate the efficacy of insulin pumps in achieving better glycemic control, reducing hypoglycemic episodes, and improving overall quality of life for diabetic individuals. As awareness grows, more healthcare providers are prescribing tubeless insulin pumps as part of comprehensive diabetes management plans, driving market demand.

Tubeless Insulin Pump Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 19.25% |

| Global Market Size in 2023 | USD 2.05 Billion |

| Global Market Size by 2033 | USD 11.93 Billion |

| U.S. Market Size in 2023 | USD 790 Million |

| U.S. Market Size by 2033 | USD 4,590 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Component, and By End-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Tubeless Insulin Pump Market Dynamics

Driver:

One of the primary drivers of the tubeless insulin pump market is the growing demand for insulin delivery systems that offer greater convenience and flexibility to diabetic patients. Traditional insulin delivery methods, such as injections and tethered insulin pumps with tubing, can be cumbersome and restrictive, impacting patients’ daily activities and quality of life. Tubeless insulin pumps address these challenges by providing discreet, wearable, and intuitive insulin delivery solutions that allow patients to manage their diabetes more effectively while maintaining their active lifestyles.

Furthermore, advancements in pump technology, such as closed-loop systems and personalized insulin dosing algorithms, are driving adoption among both patients and healthcare providers. Closed-loop systems, also known as artificial pancreas systems, automatically adjust insulin delivery based on real-time glucose monitoring, offering tighter glycemic control and reducing the burden of diabetes management on patients. These technological innovations empower patients to better control their blood sugar levels while minimizing the risk of hypoglycemia, driving the adoption of tubeless insulin pumps.

Additionally, favorable reimbursement policies and insurance coverage for insulin pump therapy contribute to market growth. Many healthcare systems and insurance providers recognize the long-term benefits of insulin pump therapy in managing diabetes complications and reducing healthcare costs associated with diabetes-related complications. As a result, they provide financial support for patients to access tubeless insulin pumps, making them more affordable and accessible to a broader population of diabetic individuals.

Restraint:

Despite the numerous benefits of tubeless insulin pumps, several factors restrain market growth. One key restraint is the high upfront cost associated with acquiring and maintaining these devices. Tubeless insulin pumps are often more expensive than traditional insulin delivery methods, such as syringes or pens, making them less accessible to economically disadvantaged patients or those without adequate insurance coverage. The initial investment in a tubeless insulin pump may deter some patients from adopting this technology, especially in regions with limited healthcare resources or where out-of-pocket expenses are prohibitive.

Moreover, technical challenges and device-related issues can hinder patient acceptance and adherence to tubeless insulin pump therapy. While tubeless insulin pumps offer significant advantages in terms of convenience and flexibility, they also require regular maintenance, troubleshooting, and technical support to ensure proper functioning. Device malfunctions, infusion site issues, or software glitches can disrupt insulin delivery and compromise patient safety, leading to frustration and dissatisfaction among users. Improvements in pump reliability, user training, and customer support are needed to address these challenges and enhance the overall user experience.

Furthermore, concerns about the long-term safety and efficacy of tubeless insulin pump therapy may impact market growth. While clinical studies have demonstrated the short-term benefits of insulin pump therapy in improving glycemic control and quality of life, there is limited long-term data on the effects of continuous insulin infusion on diabetes complications, such as cardiovascular disease, retinopathy, and neuropathy. Patients and healthcare providers may have reservations about committing to tubeless insulin pump therapy without robust evidence of its long-term safety and efficacy, especially for vulnerable populations such as children, adolescents, and pregnant women.

Opportunity:

Despite the challenges, several opportunities exist for the expansion of the tubeless insulin pump market. One significant opportunity lies in the development of innovative pump technologies that address unmet needs and preferences of diabetic patients. For example, there is growing interest in wearable insulin delivery systems that integrate with smart devices, allowing for seamless glucose monitoring, insulin dosing, and data analysis in real time. These next-generation pump technologies have the potential to revolutionize diabetes management by offering personalized, connected, and user-friendly solutions that empower patients to take control of their health.

Additionally, expanding market penetration in emerging economies presents a lucrative opportunity for tubeless insulin pump manufacturers. As the prevalence of diabetes continues to rise in regions such as Asia, Latin America, and Africa, there is an increasing demand for advanced diabetes management solutions that can improve access to care and enhance treatment outcomes. By partnering with local healthcare providers, governments, and advocacy organizations, tubeless insulin pump manufacturers can raise awareness, facilitate training, and overcome barriers to adoption in these underserved markets, driving revenue growth and market expansion.

Moreover, collaborations and strategic partnerships between pump manufacturers and other healthcare stakeholders, such as pharmaceutical companies, technology providers, and research institutions, can fuel innovation and market growth. By leveraging complementary expertise, resources, and networks, these partnerships can accelerate the development and commercialization of novel pump technologies, expand market reach, and create synergies across the diabetes care continuum. For example, collaborations between pump manufacturers and pharmaceutical companies can enable the integration of insulin delivery devices with novel insulin formulations or adjunctive therapies, offering more effective and personalized treatment options for diabetic patients.

Read Also: Protective Face Masks Market Size to Attain USD 16.32 Bn by 2033

Region Insights:

The tubeless insulin pump market is geographically diverse, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market, driven by high prevalence of diabetes, favorable reimbursement policies, and strong presence of leading pump manufacturers. The United States accounts for the largest share of the North American market, followed by Canada. Europe is also a significant market for tubeless insulin pumps, with countries such as Germany, the United Kingdom, and France leading in terms of market penetration and adoption rates. The Asia Pacific region is expected to witness rapid growth in the coming years, fueled by increasing awareness about diabetes management, rising disposable income, and expanding healthcare infrastructure in countries such as China, India, and Japan. Latin America and the Middle East and Africa represent emerging markets with untapped potential for tubeless insulin pump manufacturers, driven by improving access to healthcare, rising healthcare expenditure, and growing adoption of advanced medical technologies.

Recent Developments

- In August 2023, the Tubeless insulin pump received FDA clearance for diabetes people. The Accu-Chek Solo micropump (Roche Diabetes) was granted 510(k) clearance from the FDA. Accu-Chek Solo micropump is tubeless, small, and lightweight. Users can place the device on four different infusion sites on the body. The device is detachable, allowing people with diabetes to change the infusion site when necessary.

- In July 2023, the FDA announced the clearance of Tandem Diabetes Care’s Mobi durable automated insulin pump. The approval covers people with diabetes aged six and above, expanding Tandem’s portfolio of products. Mobi features a 200-unit insulin cartridge and an on-pump button to provide an alternative to phone control for insulin boluses.

- In February 2024, Omnipod 5 received approval to integrate with the new freestyle libre two plus sensor. The Omnipod 5 hybrid closed loop system has received approval to integrate with the Abbott FreeStyle Libre 2 Plus Sensor in the UK, which will give people living with diabetes additional choice and flexibility for managing their blood sugar levels.

- In April 2023, Insulet announced FDA clearance of Omnipod GO, a first-of-its-kind basal-only insulin pod for people with type 2 diabetes aged 18 and above. Omnipod GO is a wearable, standalone insulin delivery system that provides a fixed rate of continuous rapid-acting insulin for 72 hours.

Tubeless Insulin Pump Market Companies

- Medtronic plc

- Hoffmann-La Roche Ltd

- Tandem Diabetic Care, Inc.

- Insulet Corporation

- Ypsomed

- Cellenovo

- Abbott

- Tandem Diabetes Care

- Insulet Corporation

- Sooil Development

- Valeritas, Inc

- JingasuDelfu Co., Ltd.

- Cellnova

- Roche Holdings

- Spring Health Solutions

- Johnson & Johnson

- Medtrum Technologies

- Debiotech

- CeQur

- Valeritas Holding

- Animas Corporation

Segments Covered in the Report

By Type

- Insulin Patch Pump

- Traditional Pump

By Component

- Pod or Patch

- Remote

- Accessories

By End-users

- Hospitals

- Pharmacies

- E-commerce

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/