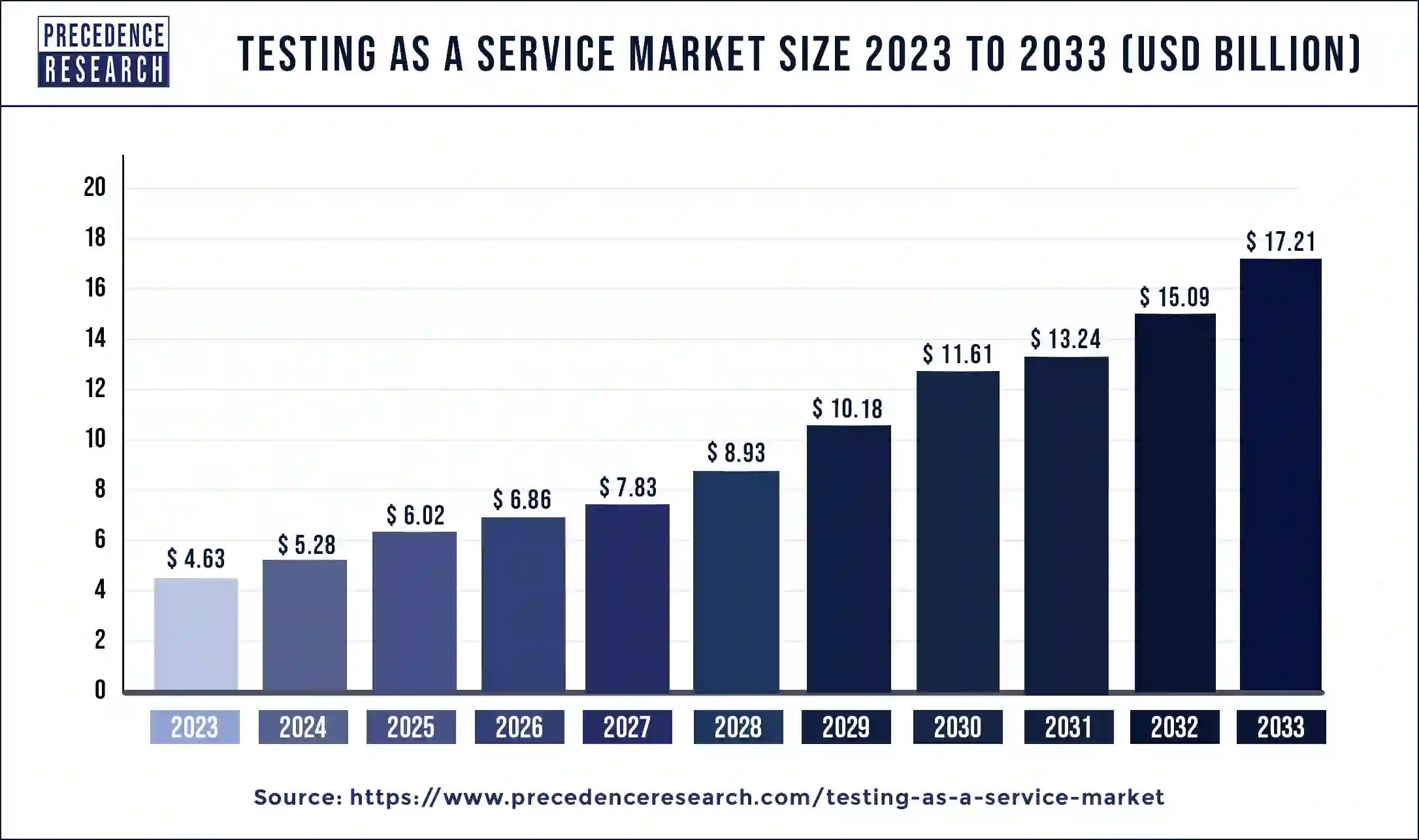

The global testing as a service market size accounted for USD 4.63 billion in 2023 and is anticipated to rake around USD 17.21 billion by 2033, growing at a CAGR of 14.03% from 2024 to 2033.

Key Points

- North America led the market with holding a 40% of market share in 2023.

- Asia Pacific is expected to witness significant growth during the forecast period.

- By test type, the functionality segment has generated more than 28% of market share in 2023.

- By test type, the security segment is expected to grow the fastest during the forecast period.

- By deployment type, the public segment held a significant share of the market in 2023.

- By deployment type, the private segment is poised to grow at a significant rate during the forecast period.

- By end use, in 2023, the IT & telecommunication segment led the market.

- By end use, the healthcare segment is expected to grow the fastest during the forecast period.

The Testing as a Service (TaaS) market has witnessed significant growth in recent years due to the increasing demand for efficient and cost-effective software testing solutions. TaaS refers to the outsourcing of testing activities to third-party service providers, allowing organizations to leverage specialized expertise, resources, and infrastructure without the need for large upfront investments. This model offers flexibility, scalability, and access to the latest testing tools and technologies, driving its adoption across various industries such as IT, healthcare, BFSI, manufacturing, and retail. The global TaaS market is poised for substantial expansion as businesses strive to deliver high-quality software products while reducing time-to-market and overall testing costs.

Get a Sample: https://www.precedenceresearch.com/sample/4043

Growth Factors:

Several factors contribute to the growth of the TaaS market. Firstly, the rapid proliferation of digital technologies and the adoption of agile and DevOps methodologies have intensified the need for continuous testing throughout the software development lifecycle. TaaS providers offer on-demand testing services that align with these agile practices, enabling faster releases and improved software quality. Additionally, the increasing complexity of software applications, coupled with the diversity of platforms and devices, necessitates comprehensive testing across various environments. TaaS solutions address this challenge by offering compatibility testing, performance testing, security testing, and other specialized services to ensure seamless user experiences across diverse ecosystems.

Furthermore, the growing emphasis on cost optimization and resource efficiency encourages organizations to outsource non-core activities such as testing. TaaS allows businesses to reduce capital expenditures on testing infrastructure and personnel while accessing a broader talent pool of testing professionals globally. Moreover, the rise of cloud computing and virtualization technologies has facilitated the delivery of testing services remotely, enabling seamless collaboration between distributed teams and improving time-to-market. As businesses prioritize digital transformation initiatives and seek to enhance software quality, the demand for TaaS is expected to surge, driving market growth in the coming years.

Region Insights:

The TaaS market exhibits a global presence, with key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market owing to the strong presence of leading TaaS providers, technological advancements, and early adoption of cloud-based testing solutions. The region’s mature IT infrastructure, coupled with the proliferation of software development activities across industries such as IT, healthcare, and BFSI, fuels market growth. Moreover, stringent regulatory requirements and the need for compliance testing further drive the demand for TaaS solutions in sectors such as healthcare and finance.

In Europe, countries like the UK, Germany, and France are witnessing significant adoption of TaaS, driven by the increasing digitization of business processes and the growing importance of quality assurance in software development. Furthermore, the Asia Pacific region is poised for rapid growth, attributed to the burgeoning IT industry, expanding digitalization initiatives, and the emergence of innovative startups offering testing services. Countries such as India, China, and Japan are leading contributors to market growth, fueled by the availability of skilled resources, cost-effective labor, and government support for IT infrastructure development.

Testing as a Service Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.03% |

| Global Market Size in 2023 | USD 4.63 Billion |

| Global Market Size by 2024 | USD 5.28 Billion |

| Global Market Size by 2033 | USD 17.21 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type, By End-use, and By Deployment Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Testing as a Service Market Dynamics

Drivers:

Several drivers propel the growth of the TaaS market. Firstly, the escalating demand for high-quality software products amid intensifying competition drives organizations to invest in robust testing solutions. TaaS providers offer specialized expertise and advanced testing tools to ensure the reliability, performance, and security of software applications, thereby enhancing customer satisfaction and brand reputation. Moreover, the increasing adoption of cloud computing and virtualization technologies accelerates the uptake of TaaS, as organizations seek flexible and scalable testing solutions that align with their dynamic business needs.

Additionally, the proliferation of IoT devices, mobile applications, and digital platforms necessitates comprehensive testing to address compatibility, performance, and security concerns. TaaS providers offer specialized testing services tailored to these emerging technologies, enabling businesses to deliver seamless user experiences across multiple devices and platforms. Furthermore, the shift towards DevOps and agile methodologies emphasizes the importance of continuous testing throughout the software development lifecycle, driving the demand for on-demand testing services offered by TaaS providers.

Opportunities:

The TaaS market presents lucrative opportunities for vendors and service providers. Firstly, the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies in testing automation enhances the efficiency and accuracy of testing processes. TaaS providers can leverage AI/ML algorithms to analyze vast datasets, identify patterns, and automate test case generation, execution, and result analysis, thereby reducing manual efforts and improving testing coverage. Moreover, the integration of TaaS with DevOps toolchains and CI/CD pipelines streamlines the testing workflow, enabling seamless collaboration between development and operations teams and facilitating faster releases with higher quality.

Furthermore, the rising demand for specialized testing services such as cybersecurity testing, blockchain testing, and AI/ML model validation presents niche opportunities for TaaS providers. By offering domain-specific expertise and tailored testing solutions, vendors can cater to the unique requirements of industries such as healthcare, fintech, automotive, and e-commerce. Additionally, the expansion of TaaS offerings to emerging markets and industries presents untapped growth opportunities for service providers. As businesses across sectors recognize the importance of quality assurance and testing in software development, the demand for TaaS is expected to proliferate, creating new avenues for market expansion and innovation.

Challenges:

Despite significant growth prospects, the TaaS market faces several challenges that may hinder its expansion. Firstly, concerns regarding data security and privacy pose challenges for TaaS adoption, particularly in industries dealing with sensitive information such as healthcare and finance. TaaS providers must adhere to stringent regulatory requirements and implement robust security measures to safeguard client data and mitigate cybersecurity risks. Moreover, the lack of standardized testing frameworks and methodologies across organizations hampers interoperability and collaboration between TaaS providers and clients.

Additionally, the dynamic nature of software development technologies and methodologies necessitates continuous innovation and upskilling of testing professionals. TaaS providers must invest in training and certification programs to ensure their workforce remains proficient in the latest testing tools, techniques, and industry best practices. Furthermore, the commoditization of testing services and pricing pressures exerted by competitive market dynamics pose challenges for TaaS providers in maintaining profitability and sustaining growth. To differentiate themselves in the market, vendors must focus on delivering value-added services, industry expertise, and innovative testing solutions that address evolving customer needs and market trends.

Read Also: Nutraceutical Packaging Market Size to Grow USD 5.86 Bn by 2033

Recent Developments

- In January 2024, Capgemini SE introduced the “CLOUD DE CONFIANCE” platform. This platform provides the specific cloud needs of the French State, public agencies, hospitals, regional authorities, Vital Importance Operators (OIVs), and Essential Service Operators (OSEs), enabling them to use Microsoft 365 and Microsoft Azure services.

- In December 2023, IBM Corporation took over Software AG, a German multinational software corporation. Through this acquisition, IBM would enhance its business portfolio by creating hybrid cloud and cutting-edge AI solutions for enterprises with a distinct and compelling appeal.

- In November 2023, Accenture PLC came into partnership with Vodafone Group Plc, a British multinational telecommunications company. Through this partnership, Accenture PLC would enhance its technology and transformation services business.

- In November 2023, DXC Technology Company entered into a partnership with Amazon Web Services, Inc., an IT Services and IT Consulting company. Through this partnership, DXC Technology Company would expedite the transfer of its fundamental enterprise systems to cloud infrastructure.

Testing as a Service Market Companies

- Accenture

- Atos SE

- Capgemini

- DeviQA Solutions

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- IBM Corporation

- Infosys Limited

- TATA Consultancy Services Limited

- Qualitest Group

Segments Covered in the Report

By Test Type

- Functionality

- Performance

- Compatibility

- Security

- Compliance

- Others

By End-use

- IT & telecommunication

- Healthcare

- BFSI

- Automotive

- Manufacturing

- Retail & Consumer Goods

- Energy & Utilities

- Others

By Deployment Type

- Public

- Private

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/