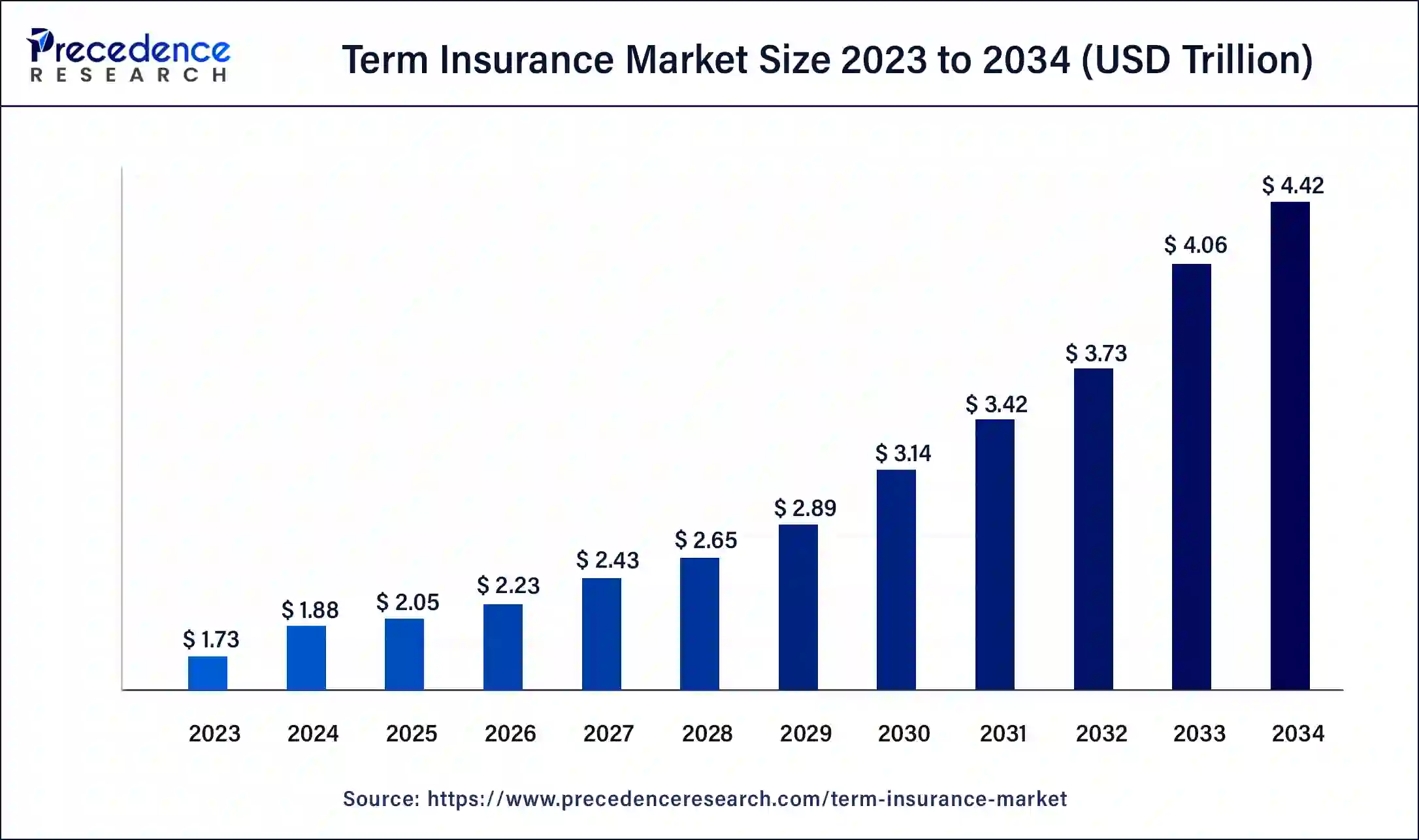

The global term insurance market size accounted for USD 1.73 trillion in 2023 and is anticipated to hit around USD 4 trillion by 2033, growing at a CAGR of 8.75% from 2024 to 2033.

Key Points

- Asia-Pacific has contributed more than 34% of market share in 2023.

- Europe is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, in 2023, the individual-level term life insurance segment has held the highest market share of 76%.

- By type, the group-level term insurance segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

- By distribution channel, the tied agents & branches segment has held 53% market share in 2023.

- By distribution channel, the light brokers segment is anticipated to witness rapid growth over the projected period.

The term insurance market is a segment of the insurance industry that offers coverage for a specified period, known as the policy term. Unlike permanent life insurance policies, which provide coverage for the insured’s entire life, term insurance policies offer coverage for a predetermined duration, typically ranging from 5 to 30 years. Term insurance is designed to provide financial protection to beneficiaries in the event of the insured’s death during the policy term. This overview delves into the key aspects of the term insurance market, including its growth drivers, regional insights, opportunities, and challenges.

Get a Sample: https://www.precedenceresearch.com/sample/3989

Growth Factors

Several factors contribute to the growth of the term insurance market. One significant factor is increasing awareness among individuals about the importance of financial planning and risk management. As people become more aware of the need to protect their families’ financial well-being in the event of untimely death, demand for term insurance policies rises. Moreover, demographic trends such as population growth, rising incomes, and changing lifestyle preferences drive demand for insurance products, including term insurance. Additionally, advancements in technology and digital distribution channels have made it easier for insurers to reach a wider audience and offer customized products, further fueling market growth.

Region Insights:

The term insurance market exhibits varying dynamics across different regions globally. In mature insurance markets such as North America and Europe, term insurance products are well-established and widely adopted as part of overall financial planning strategies. These regions benefit from robust regulatory frameworks, sophisticated distribution channels, and a high level of consumer awareness about insurance products. In contrast, emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities for term insurance providers due to growing economies, expanding middle-class populations, and increasing disposable incomes.

Term Insurance Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.75% |

| Global Market Size in 2023 | USD 1.73 Trillion |

| Global Market Size by 2033 | USD 4 Trillion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Term Insurance Market Dynamics

Drivers

Several drivers propel the growth of the term insurance market. One key driver is the need for financial protection against unforeseen events such as death, disability, or critical illness. Term insurance provides individuals with a cost-effective way to secure financial stability for their loved ones in case of premature death. Additionally, favorable regulatory environments, tax incentives, and innovative product offerings encourage individuals to purchase term insurance policies as part of their overall financial planning strategy. Moreover, increasing competition among insurers leads to product innovation, improved customer service, and competitive pricing, driving market growth.

Opportunities

The term insurance market presents various opportunities for insurers to expand their business and reach new customer segments. With increasing digitalization and internet penetration, insurers can leverage online platforms and digital distribution channels to enhance customer engagement, streamline underwriting processes, and reduce administrative costs. Moreover, partnerships with banks, financial advisors, and other distribution partners enable insurers to broaden their reach and penetrate underserved markets. Additionally, rising consumer awareness about the importance of insurance and retirement planning creates opportunities for insurers to offer bundled products and comprehensive solutions that meet evolving customer needs.

Challenges

Despite its growth prospects, the term insurance market faces several challenges that may impede its expansion. One significant challenge is the low penetration and awareness of insurance products, particularly in emerging markets. Limited understanding of insurance concepts, cultural barriers, and trust issues pose challenges to market penetration and customer acquisition. Moreover, regulatory complexities, compliance requirements, and market volatility create operational challenges for insurers, necessitating robust risk management frameworks and agile business strategies. Additionally, changing customer preferences, evolving regulatory landscapes, and competitive pressures require insurers to continuously adapt and innovate to stay ahead in the market.

Read Also: Compartment Syndrome Monitoring Devices Market Size, Report 2033

Recent Developments

- In December 2023, The Smart Total Elite Protection Plan, a comprehensive term life insurance policy created to fit modern lifestyles, was unveiled by Max Life Insurance Company. This plan provides broad coverage that is tailored to changing customer needs.

- In June 2023, after receiving an IRDAI license in just two weeks, Go Digit Life Insurance Limited, a life insurance company supported by modern technology, started operations. In order to “Make insurance simple,” the “Digit Life Group Term Insurance” plan will prioritize providing high customizability to its clients, or groups.

- In May 2023, The American mutual life insurer New York Life debuted a broad selection of affordably cost term life insurance products. These services increase the return on clients’ investments in protection while preparing them for opportunities and financial uncertainty.

Term Insurance Market Companies

- MetLife (United States)

- AIA Group Limited (Hong Kong)

- Prudential Financial Inc. (United States)

- Manulife Financial Corporation (Canada)

- China Life Insurance Company Limited (China)

- Allianz SE (Germany)

- New York Life Insurance Company (United States)

- Japan Post Holdings Co., Ltd. (Japan)

- Ping An Insurance (Group) Company of China, Ltd. (China)

- Northwestern Mutual Life Insurance Company (United States)

- State Farm Mutual Automobile Insurance Company (United States)

- AXA S.A. (France)

- Dai-ichi Life Holdings, Inc. (Japan)

- Zurich Insurance Group Ltd. (Switzerland)

- LIC (Life Insurance Corporation of India) (India)

Segments Covered in the Report

By Type

- Individual Level Term Life Insurance

- Group Level Term Life Insurance

- Decreasing Term Life Insurance

By Distribution Channel

- Tied Agents & Branches

- Brokers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/