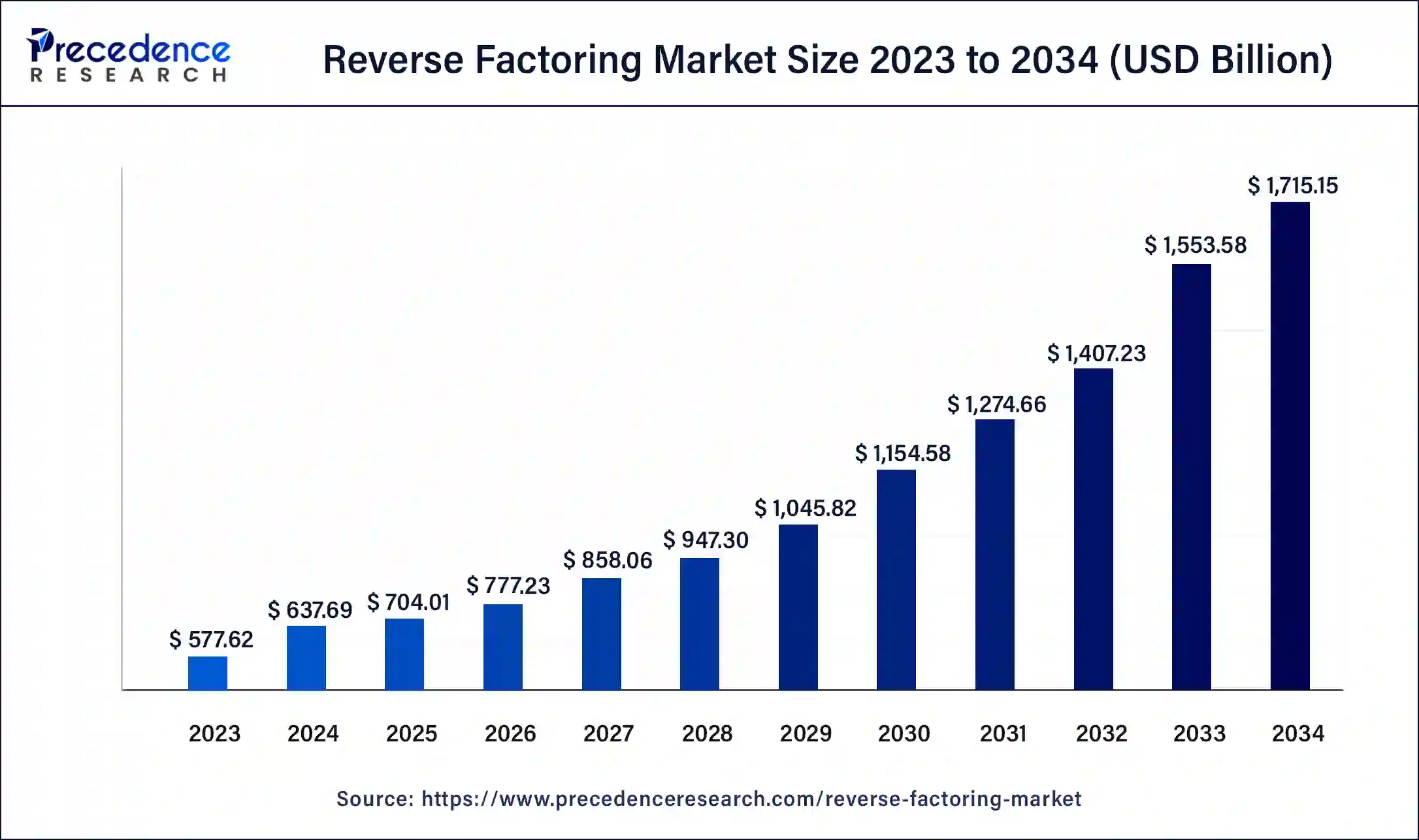

The global reverse factoring market size accounted for USD 577.62 billion in 2023 and is anticipated to attain around USD 1,527.05 billion by 2033, expanding at a CAGR of 10.21% from 2024 to 2033.

Key Points

- Europe has contributed more than 50% of market share in 2023.

- By category, the domestic segment held the largest market share in 2023.

- By category, the international segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By financial institution, the bank segment has generated the biggest market share in 2023.

- By financial institution, the non-banking financial institutions segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the manufacturing segment has led the significant market share in 2023.

- By end-use, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

Reverse factoring, also known as supply chain financing, is a financial arrangement that allows businesses to optimize their cash flow by providing early payment to suppliers. In this market, a financing institution, often a bank or a financial services provider, facilitates the process by offering to pay invoices on behalf of the buyer to the supplier. The buyer then repays the financing institution at a later date, typically with a small fee or interest charge.

Get a Sample: https://www.precedenceresearch.com/sample/3985

One of the key drivers of the reverse factoring market is the need for businesses to manage their working capital effectively. By offering early payment to suppliers, buyers can negotiate favorable terms, secure discounts, and strengthen their relationships with suppliers. This, in turn, can lead to improved supply chain efficiency, reduced inventory costs, and increased profitability.

The reverse factoring market is also influenced by the growing demand for supply chain finance solutions from businesses across various industries. As global supply chains become increasingly complex and interconnected, companies are seeking innovative ways to optimize their cash flow and mitigate financial risks. Reverse factoring offers a flexible and cost-effective financing option that can help businesses manage their cash flow fluctuations and improve liquidity.

Moreover, the rise of digital platforms and technology solutions has further accelerated the growth of the reverse factoring market. Digitalization has made it easier for businesses to streamline their supply chain finance processes, automate transactions, and enhance visibility and transparency across the supply chain. This has led to greater adoption of reverse factoring solutions by both buyers and suppliers, driving market growth.

Regionally, the reverse factoring market is witnessing significant growth across both developed and emerging economies. In developed regions such as North America and Europe, mature financial markets and robust regulatory frameworks have contributed to the widespread adoption of supply chain finance solutions. Meanwhile, in emerging markets, rapid industrialization, urbanization, and the expansion of global supply chains are driving demand for reverse factoring to support the growth of domestic businesses.

Reverse Factoring Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.21% |

| Global Market Size in 2023 | USD 577.62 Billion |

| Global Market Size by 2033 | USD 1,527.05 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Category, By Financial Institution, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Reverse Factoring Market Dynamics

Despite its growth potential, the reverse factoring market also faces several challenges. One challenge is the complexity of implementing supply chain finance programs, particularly for businesses with large and diverse supplier networks. Effective collaboration and communication between buyers, suppliers, and financing institutions are essential to overcome barriers and ensure the success of reverse factoring initiatives.

Additionally, concerns about the impact of reverse factoring on supplier relationships and working conditions have drawn scrutiny from regulators and stakeholders. There are concerns that extended payment terms associated with reverse factoring arrangements may exert financial pressure on suppliers, particularly small and medium-sized enterprises (SMEs), and disrupt the stability of the supply chain.

Read Also: Aviation IoT Market Size to Attain USD 69.51 Billion by 2033

Recent Developments

- In October 2022, HSBC Hong Kong, a wholly-owned subsidiary of the HSBC Group, unveiled Trade Platform, a comprehensive e-platform designed to offer flexibility, safety, and security in managing global trade transactions. It caters to trade loans for sellers and buyers, guarantees, import bills, and import documents for credit.

- In December 2022, Endesa, in collaboration with Banco Bilbao Vizcaya Argentaria, Caixabank, and Santander, introduced a circular reverse factoring solution. This innovative initiative includes incentives and rewards for sustainable practices, thereby enhancing their competitiveness within the economy.

Reverse Factoring Market Companies

- Citibank

- HSBC

- Santander

- Banco Bilbao Vizcaya Argentaria (BBVA)

- Caixabank

- JPMorgan Chase

- Bank of America

- BNP Paribas

- Deutsche Bank

- Barclays

- Société Générale

- Credit Suisse

- ING Group

- Wells Fargo

- Standard Chartered

Segments Covered in the Report

By Category

- Domestic

- International

By Financial Institution

- Banks

- Non-banking Financial Institutions

By End-use

- Manufacturing

- Transport & Logistics

- Information Technology

- Healthcare

- Construction

- Others (Retail, Food & Beverages, Among Others)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/