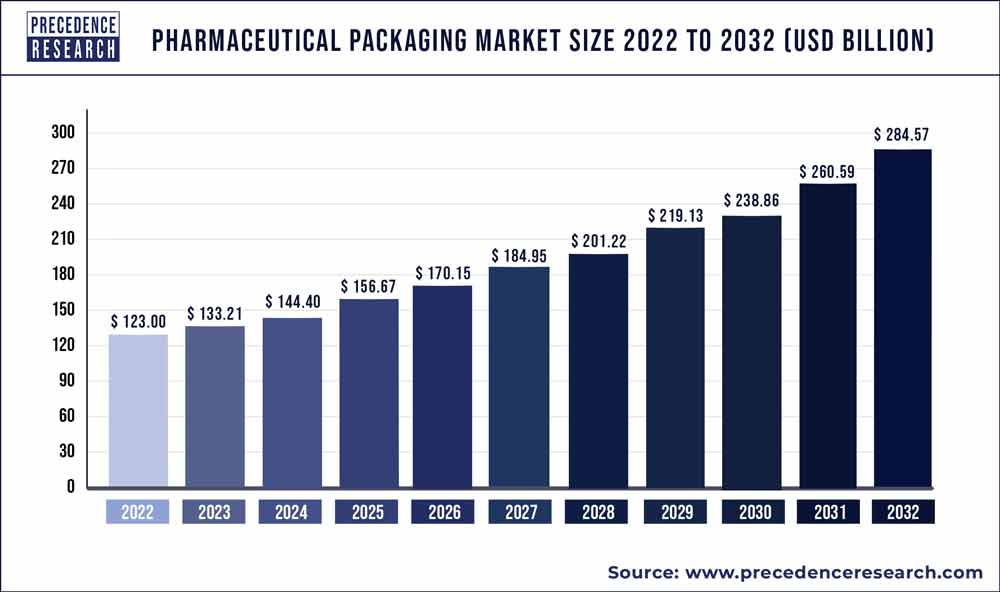

The global pharmaceutical packaging market size reached USD 123 billion in 2022 and is projected to grow to USD 284.57 billion by 2032, with a CAGR of 8.8% between 2023 to 2032

Key Takeaways

- North America contributed more than 38% of revenue share in 2022.

- Asia-Pacific is expected to expand at the biggest CAGR of 12.3% between 2023 and 2032.

- By Product, the primary pharmaceutical packaging segment has held the largest market share of 76% in 2022.

- By Product, the secondary product segment is anticipated to grow at a remarkable CAGR of 7.6% between 2023 and 2032.

- By Application, the pharmaceutical manufacturing segment captured more than 49.7% of revenue share in 2022.

Pharmaceutical packaging is commonly defined as the packaging materials used for packaging of pharmaceutical products. These materials are manufactured using drug-compatible materials that provide identification, protection, as well as ensure the reliability of the enclosed drug. Primary and secondary solutions of packaging are largely used to protect the enclosed product from biological, chemical, mechanical, and climatic hazards.

Blisters, bottles, caps & closures, labels & accessories, pouches & strip packs, pre-filled syringes, vials, pre-filled inhalers, jars & canisters, ampoules medication tubes, and cartridges are part of the primary packaging product segment. However, secondary packaging solutions include paperboard boxes and temperature-controlled packaging. Pharmaceutical packaging products are manufactured using a variety of raw materials that include paper & paperboards, plastics & polymers, aluminum foil, glass, and others. Primary packaging products are made using materials for example glass, plastics & polymers, and aluminum foil.

Get a Sample: https://www.precedenceresearch.com/sample/1136

Growth Factors

Growing pharmaceutical industry especially in the developing countries because of high spending on healthcare infrastructure growth along with rising health awareness in the countries expected to prominently drive the market growth. Further, increasing demand for patient-oriented drugs and medicines is the other most important factor that triggers the demand for pharmaceutical packaging solution.

Demographic trends that include rising population along with rapid aging of population expected to fuel the requirement for pharmaceutical products, thereby propels the growth for pharmaceutical packaging solution over the analysis period. In addition, increasing demand for generic drugs because of their affordability along with development of new drugs further projected to drive the market growth for pharmaceutical packaging during the forthcoming years.

Various packing solutions used for pharmaceuticals effectively prevent the contamination as well as they offer drug safety along with the convenience in transportation and handling. Hence, pharmaceutical packaging is required for balancing several complex factors. Apart from this, high cost of these packaging solutions due to anti-counterfeiting efforts and stringent regulations is likely to hamper the market growth. Thus, rising packaging costs is one of the major challenges faced by the manufacturers of pharmaceutical packaging solutions.

Report Scope of the Pharmaceutical Packaging Market

| Report Highlights | Details |

| Market Size in 2023 | USD 133.21 Billion |

| Market Size by 2032 | USD 284.57 Billion |

| Growth Rate From 2023 to 2032 | CAGR of 8.8% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Application, Material |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

| Companies Mentioned | Becton, Dickinson and Company, Amcor Plc, AptarGroup, Inc., Gerresheimer AG, Drug Plastics Group, Schott AG, West Pharmaceutical Services Inc., Owens Illinois Inc., Berry Global, Inc, SGD S.A., WestRock Company |

Regional Snapshots

North America is commonly known for the technological advancements along with product innovations that motivate drug manufacturers to offer advanced packaging solutions within the pharmaceutical industry. Major factors contributing towards the growth of the region include advancement in nanotechnology used for manufacturing processes coupled with the technological innovation, rising demand for blister packaging and drug delivery devices, to the pharmaceutical packaging market.

The United States anticipated being the largest pharmaceutical packaging market in North America because of its advanced drug production facility that commercializes new and sophisticated therapies that require specialized packaging solutions. However, the Asia Pacific expected to grow at a prominent rate over the analysis period owing to rising health awareness and disposable income in the region.

Key Players & Strategies

The global leaders in the pharmaceutical packaging industry are present on both regional and local level that turns the market into fragmented. Further, these market players are focusing prominently on the product development and enhancement. In the wake of same, they invest significantly on the R&D sector. This strategy of the leading industry participants also helps them to maintain their position as well as to grab maximum hold on the global market.

Some of the key players operating in the market are Becton, Dickinson and Company, Amcor Plc, AptarGroup, Inc., Gerresheimer AG, Drug Plastics Group, Schott AG, West Pharmaceutical Services Inc., Owens Illinois Inc., Berry Global, Inc, SGD S.A., WestRock Company, International Paper Company, CCL Industries Inc., COMAR LLC, and Vetter Pharma International among others.

Segments Covered in the Report

By Product

- Tertiary

- Secondary

- Pharmaceutical Packaging Accessories

- Prescription Containers

- Primary

- Caps & Closures

- Plastic Bottles

- Parenteral Containers

- Prefillable Inhalers

- Blister Packs

- Medication Tubes

- Pouches

- Others

By Material

- Paper & Paperboard

- Plastics & Polymers

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Others

- Glass

- Aluminum Foil

- Others

By Application

- Retail Pharmacy

- Pharmaceutical Manufacturing

- Institutional Pharmacy

- Contract Packaging

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308