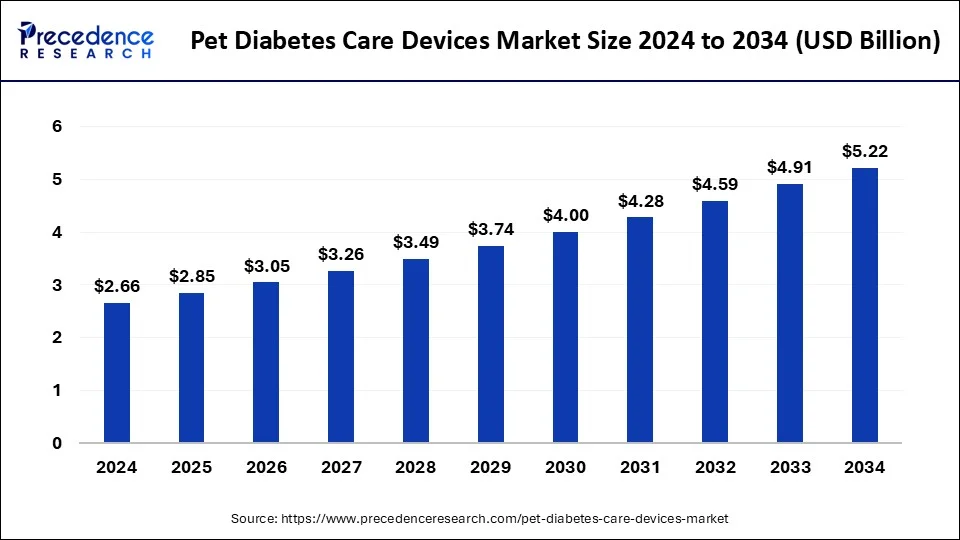

The global pet diabetes care devices market size accounted for USD 2.48 billion in 2023 and is predicted to grow around USD 4.91 billion by 2033, growing at a CAGR of 7.05% from 2024 to 2033.

Key Points

- North America held the largest market share of 37% in 2023.

- The Asia-Pacific region is observed to witness the fastest rate of expansion during the forecast period.

- By device, the insulin delivery devices segment has contributed more than 93% of the market share in 2023.

- By animal, the dogs segment led the market with the major market share of 55% in 2023.

- By end-users, the veterinary hospitals segment has recorded more than 42% of the market share in 2023.

The pet diabetes care devices market has witnessed notable growth in recent years due to the rising prevalence of diabetes among pets, increasing awareness about pet healthcare, and advancements in veterinary medicine. Diabetes mellitus, a chronic metabolic disorder characterized by high blood glucose levels, affects a significant number of dogs and cats worldwide. As pet owners become more proactive about managing their pets’ health, the demand for diabetes care devices such as glucose monitoring systems, insulin delivery devices, and related accessories has surged. This market offers opportunities for innovation, collaboration between veterinary professionals and device manufacturers, and improved quality of life for diabetic pets.

Get a Sample: https://www.precedenceresearch.com/sample/3970

Table of Contents

ToggleGrowth Factors:

Several factors contribute to the growth of the pet diabetes care devices market. Firstly, the increasing incidence of diabetes among pets, particularly dogs and cats, drives the demand for diabetes management products and services. Factors such as genetic predisposition, obesity, aging, and dietary habits contribute to the rising prevalence of diabetes in companion animals. As pet owners become more attuned to their pets’ health needs, they seek effective solutions to monitor blood glucose levels and administer insulin therapy.

Furthermore, advancements in veterinary diagnostics and therapeutics have facilitated early detection and management of diabetes in pets. Technological innovations such as continuous glucose monitoring (CGM) systems, portable glucometers, and insulin pumps enable pet owners and veterinarians to monitor blood glucose levels accurately and adjust treatment regimens accordingly. These devices offer convenience, precision, and real-time data insights, enhancing the quality of diabetes care for pets.

Moreover, growing awareness about the importance of pet healthcare and wellness has led to increased spending on veterinary services and products. Pet owners are willing to invest in diabetes management devices, medications, and specialized diets to ensure the well-being of their diabetic pets. Veterinary clinics and hospitals are also expanding their range of services to include diabetes management programs, thereby driving the adoption of diabetes care devices in the pet healthcare sector.

Additionally, collaborative efforts between veterinary professionals, pet industry stakeholders, and medical device manufacturers have contributed to the development of innovative diabetes care solutions for pets. Research institutions, veterinary schools, and industry associations play a vital role in advancing knowledge, training, and best practices in pet diabetes management. Collaborative initiatives aimed at raising awareness, conducting clinical trials, and improving access to diabetes care devices further fuel market growth.

Region Insights:

The adoption of pet diabetes care devices varies across regions, influenced by factors such as pet population demographics, veterinary infrastructure, regulatory environment, and socioeconomic factors. In North America, the United States and Canada lead the market for pet diabetes care devices, driven by a large pet population, high levels of pet ownership, and advanced veterinary healthcare services. The region’s well-established veterinary industry, extensive network of pet clinics, and technological advancements support the adoption of diabetes management solutions for pets.

In Europe, countries such as the United Kingdom, Germany, and France are significant markets for pet diabetes care devices, benefiting from a growing awareness of pet health issues, increasing pet humanization trends, and expanding pet insurance coverage. Veterinary professionals in Europe are increasingly incorporating diabetes management services into their practice, offering comprehensive care for diabetic pets. Additionally, favorable reimbursement policies and regulatory frameworks support the availability and accessibility of diabetes care devices in the region.

In Asia Pacific, countries like Japan, Australia, and China are witnessing growing demand for pet diabetes care devices, driven by rising pet ownership rates, urbanization, and increasing disposable income levels. As pet owners prioritize their pets’ health and well-being, they seek advanced healthcare solutions, including diabetes management devices and services. Veterinary clinics and pet healthcare providers in Asia Pacific are expanding their offerings to meet the evolving needs of pet owners, contributing to market growth.

In Latin America and the Middle East & Africa, the pet diabetes care devices market is nascent but rapidly growing, fueled by expanding pet ownership, urbanization, and improving standards of veterinary care. Despite challenges such as limited access to veterinary services and economic constraints, pet owners in these regions are increasingly investing in pet healthcare products and services, including diabetes management devices. Collaborative efforts between public and private stakeholders are essential to address barriers to market entry and promote awareness of pet diabetes management in these regions.

Pet Diabetes Care Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.05% |

| Global Market Size in 2023 | USD 2.48 Billion |

| Global Market Size by 2033 | USD 4.91 Billion |

| U.S. Market Size in 2023 | USD 640 Million |

| U.S. Market Size by 2033 | USD 1,270 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Device, By Animal, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pet Diabetes Care Devices Market Dynamics

Drivers:

Several drivers are propelling the growth of the pet diabetes care devices market. Firstly, the increasing prevalence of diabetes among pets, particularly dogs and cats, is a primary driver of market demand. Factors such as genetic predisposition, obesity, sedentary lifestyle, and dietary habits contribute to the rising incidence of diabetes in companion animals. As pet owners become more aware of diabetes symptoms and risk factors, they seek effective solutions for diagnosis, monitoring, and treatment of the condition.

Moreover, the humanization of pets and changing attitudes towards pet healthcare drive the demand for advanced medical solutions, including diabetes care devices. Pet owners view their pets as family members and are willing to invest in their health and well-being, including the management of chronic conditions like diabetes. The growing pet humanization trend translates into increased spending on veterinary services, medications, and medical devices, supporting market growth.

Furthermore, advancements in veterinary diagnostics and therapeutics have expanded the range of available diabetes management options for pets. Technological innovations such as CGM systems, implantable glucose sensors, and insulin delivery devices offer pet owners and veterinarians greater convenience, accuracy, and flexibility in managing diabetes. These devices enable continuous monitoring of blood glucose levels, personalized treatment regimens, and improved outcomes for diabetic pets.

Additionally, collaborative efforts between veterinary professionals, pet industry stakeholders, and medical device manufacturers drive innovation and market expansion in the pet diabetes care sector. Research institutions, veterinary schools, and industry associations collaborate on research projects, clinical trials, and educational initiatives to advance knowledge and best practices in pet diabetes management. Joint ventures, partnerships, and licensing agreements between companies facilitate the development and commercialization of new diabetes care devices for pets.

Opportunities:

The pet diabetes care devices market presents numerous opportunities for stakeholders across the value chain. Firstly, there is a growing demand for innovative and user-friendly diabetes management solutions that offer greater convenience, accuracy, and efficiency in pet healthcare. Companies can capitalize on this opportunity by developing next-generation diabetes care devices with advanced features such as wireless connectivity, cloud-based data storage, and mobile app integration, enhancing the user experience and improving treatment outcomes for diabetic pets.

Moreover, there is a significant opportunity to expand market reach and penetration through strategic partnerships and distribution agreements. Collaborations between medical device manufacturers, veterinary clinics, pet retailers, and online platforms can facilitate access to diabetes care devices for pet owners, driving market growth and adoption. By leveraging existing distribution networks and customer relationships, companies can effectively market and sell their diabetes management products to a broader audience of pet owners.

Furthermore, there is a growing trend towards personalized medicine and precision healthcare in the pet industry, creating opportunities for customized diabetes management solutions tailored to individual pet needs. Companies can develop innovative diagnostic tools, treatment algorithms, and therapeutic options based on pet-specific factors such as breed, age, weight, and medical history. Personalized diabetes care devices can improve treatment efficacy, reduce complications, and enhance the quality of life for diabetic pets, thereby driving market demand and differentiation.

Additionally, investments in research and development (R&D) aimed at advancing diabetes care technology for pets can unlock new opportunities for innovation and market growth. Breakthroughs in sensor technology, artificial intelligence (AI), and data analytics can enable the development of smarter, more predictive diabetes management solutions that anticipate and respond to pet health needs in real-time. Companies that invest in R&D and maintain a competitive edge in technology innovation stand to gain a significant market advantage in the pet diabetes care.

Read Also: Vibration Sensor Market Size to Attain USD 12.44 Bn by 2033

Recent Developments

- In November 2023, Boehringer Ingelheim got approval for SENVELGO® in Europe. This is the first oral liquid medication available for diabetic cats, and it represents a significant advancement in treating feline diabetes in Europe. SENVELGO® can be given to cats once a day, either mixed with a small amount of food or directly administered into their mouth.

- In May 2023, UBI introduced the Petrackr, a diabetes monitoring device for pets. The product consists of a device and single-use test strips for collecting a small drop of blood sample and a hand-held monitor that can supervise multiple profiles of pets. The device accurately tracks, monitors, and displays the blood glucose levels of pets. The product has distribution partnerships in the United States and Canada.

- In Feb 2023, ALRT, a Singapore-based medical device company, launched GluCurve Pet CGM. It is a continuous monitoring device for diabetic cats and dogs produced in collaboration with Covetrus. It is designed to make diabetes management more effortless.

Pet Diabetes Care Devices Market Companies

- Merck animal health

- Becton

- Fitbark

- TaiDoc

- Dickinson

- Allison Medical

- Henry Schein

- Zoetis

- Ulticare

- Boehringer Ingelheim Vetmedica Inc.

- IDEXX Laboratories

- Johnson & Johnson Services, Inc

- Novo Nordisk

- Eli Lilly and Company

- Vetoquinol S.A.

Segments Covered in the Report

By Device

- Glucose Monitoring Devices

- Insulin Delivery Devices

- Insulin Delivery Pen

- Insulin Delivery Syringes

By Animal

- Dogs

- Cats

- Horses

By End-use

- Veterinary Clinics

- Home Care Settings

- Veterinary Hospitals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/