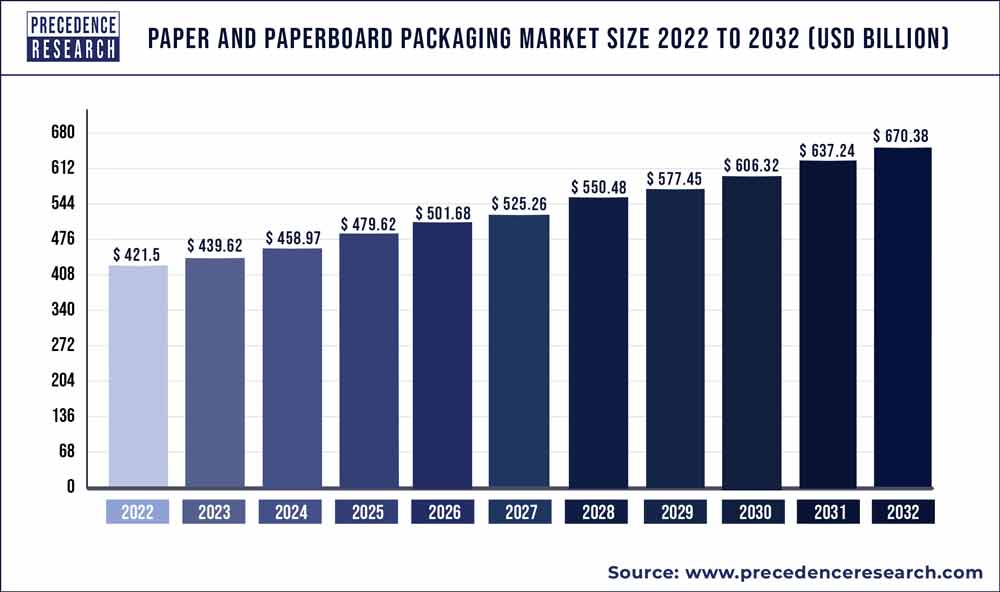

The global paper and paperboard packaging market size was estimated to be around US$ 421.5 billion in 2022. It is projected to reach US$ 670.38 billion by 2032, indicating a CAGR of 4.80% from 2023 to 2032.

Key Takeaways

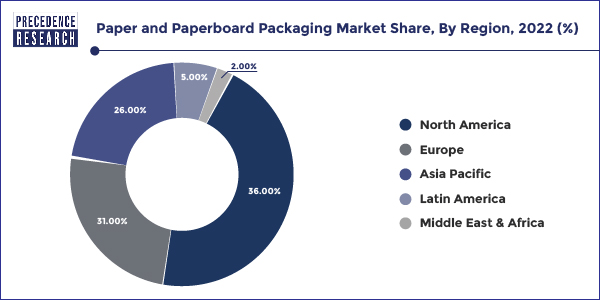

- North America held the largest share of the market at 36% in 2022.

- Asia Pacific is projected to expand at the fastest CAGR during the forecast period.

- By Product Type, the folding cartons segment held the largest market share of 53% in the paper and paperboard packaging market in 2022.

- By Product Type, the corrugated boxes segment is expected to grow at a notable CAGR of 7.1% over the projected period.

- By End-user, the food and beverages segment had the largest market share of 69% in 2022.

- By End-user, the personal care segment is predicted to grow at a remarkable CAGR during the forecast period.

The Paper and Paperboard Packaging Market is a dynamic sector within the global packaging industry. This market primarily revolves around the production and utilization of paper-based materials for packaging various goods. With an increasing emphasis on sustainable and eco-friendly packaging solutions, paper and paperboard have gained prominence due to their biodegradable nature and renewability. This market caters to a diverse range of industries, including food and beverage, pharmaceuticals, personal care, and more. The versatility of paper and paperboard packaging makes it a popular choice for manufacturers seeking both practicality and environmental responsibility.

Get a Sample: https://www.precedenceresearch.com/sample/3474

Growth Factors

Several key factors contribute to the growth of the Paper and Paperboard Packaging Market. One significant driver is the growing awareness and demand for sustainable packaging solutions. As consumers become more environmentally conscious, businesses are compelled to adopt eco-friendly materials, boosting the demand for paper and paperboard packaging. Additionally, regulatory initiatives and policies favoring the reduction of plastic waste have further propelled the growth of this market.

The e-commerce boom has also played a pivotal role in the expansion of the Paper and Paperboard Packaging Market. With the rise of online shopping, there is an increased need for sturdy and reliable packaging to ensure the safe transportation of products. Paper and paperboard materials provide a cost-effective and reliable solution, meeting the packaging demands of the e-commerce industry.

Furthermore, innovations in manufacturing processes and technologies have enhanced the quality and performance of paper and paperboard packaging. Advanced printing techniques, coatings, and design capabilities have made these materials more attractive and functional, influencing their adoption across various industries.

Paper and Paperboard Packaging Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 439.62 Billion |

| Market Size by 2032 | USD 670.38 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.80% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product Type and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Palladium Chloride Market Size to Record US$ 16.21 Billion by 2032

Regional Snapshot

In 2022, North America claimed the largest share of revenue at 36%. The paper and paperboard packaging market in North America is characterized by a strong commitment to sustainability and eco-friendliness. As consumers increasingly prioritize environmentally responsible packaging, there is a rising preference for paper and paperboard materials. The region is witnessing a shift towards reducing plastic usage in favor of recyclable and biodegradable packaging solutions. The growth of e-commerce during the pandemic has also contributed to an increased demand for robust and protective paper-based packaging. Furthermore, personalized packaging, driven by digital printing technologies, is gaining traction to enhance brand differentiation and consumer engagement.

The Asia-Pacific region is expected to experience the fastest expansion. The paper and paperboard packaging market in Asia-Pacific is on a robust growth trajectory influenced by economic expansion, urbanization, and a growing middle-class population. The trend of lightweight and sustainable packaging is particularly prominent in this region, aligning with cost-efficiency and environmental considerations. Customized packaging solutions, especially for food and beverage products, are on the rise to cater to diverse consumer preferences. The adoption of digital printing for branding and marketing purposes is gaining momentum, enhancing product visibility and appealing to the tech-savvy consumers in the region.

In the European paper and paperboard packaging market, sustainability remains a dominant trend. European consumers are increasingly eco-conscious, leading to a surge in demand for sustainable packaging solutions. Manufacturers are responding by adopting recyclable, biodegradable, and FSC-certified paper and paperboard materials. Another noteworthy trend is the emphasis on minimalist and functional packaging designs, reflecting European consumers’ preference for simplicity and functionality. Additionally, digital printing technologies are gaining popularity, enabling customized and visually appealing packaging that resonates with European aesthetics.

Product Type

The market for paper and paperboard packaging is characterized by a diverse range of product types. These include corrugated boxes, folding cartons, paper bags, and others. Corrugated boxes, known for their durability and strength, find extensive use in shipping and transportation. Folding cartons, on the other hand, are popular for retail packaging, providing an attractive and cost-effective solution. Paper bags, appreciated for their eco-friendly nature, are gaining prominence in various industries as a sustainable packaging option.

End-user

The demand for paper and paperboard packaging is driven by a multitude of end-user industries, each with unique requirements. The food and beverage sector is a major consumer, utilizing paper and paperboard packaging for products ranging from cereals to beverages. The healthcare industry relies on sterile and secure packaging for pharmaceuticals and medical devices. The e-commerce boom has significantly increased the demand for sturdy and reliable packaging materials, further fueling the market. Additionally, industries such as personal care, electronics, and automotive also contribute significantly to the diverse landscape of end-users for paper and paperboard packaging.

The versatility of paper and paperboard as packaging materials, coupled with their environmentally friendly attributes, positions them as key players in the packaging industry, meeting the varied needs of different products and industries. The ongoing emphasis on sustainability and eco-friendly packaging solutions is likely to further drive the growth of the paper and paperboard packaging market across these diverse segments.

Recent Developments

- In 2022, WestRock Company successfully acquired Grupo Gondi’s remaining interest for USD 970 million plus debt assumption. The acquisition includes four paper mills, nine corrugated packaging facilities, and six high graphic facilities in Mexico. This strengthens WestRock’s position in Latin America’s expanding corrugated packaging, consumer goods, paperboard, and containerboard markets.

- In 2022, Mondi concluded the merger of Mondi Tire Kutsan and Mondi Olmuksan to create Mondi Turkey Oluklu Mukavva. This new entity, part of Mondi’s corrugated packaging business, operates nine corrugated packaging facilities, a containerboard mill in Tire, Turkey, and a wastepaper collection facility in Adana, Turkey. Mondi holds an 84.65% ownership in Mondi Turkey Oluklu Mukavva, which employs approximately 1,600 workers and is traded on the Istanbul Stock Exchange (BIST).

- In 2022, In collaboration with FRESH!PACKING, Mondi introduced the Fresh!Bag, an advanced cooler bag designed for transporting frozen or chilled foods. The bag’s exterior layer is constructed entirely from Mondi’s robust kraft paper, replacing non-recyclable multi-material packaging. The cooling section is made from Ipulp, enclosed in recyclable kraft paper, simplifying bag construction.

- In 2022, Smurfit Kappa announced its acquisition of PaperBox, a packaging facility located in Saquarema, Brazil. This strategic move expanded Smurfit Kappa’s operational footprint in Brazil, complementing its existing presence in Minas Gerais, Rio Grande do Sul, and Ceará, strengthening the company’s position in the Brazilian packaging market.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Paper and Paperboard Packaging Market Players

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- DS Smith Plc

- Georgia-Pacific LLC

- Tetra Pak International S.A.

- Amcor plc

- Sonoco Products Company

- Sealed Air Corporation

- Huhtamaki Oyj

- Cascades Inc.

- Graphic Packaging Holding Company

- BillerudKorsnäs AB

- Mayr-Melnhof Karton AG

Segments Covered in the Report

By Product Type

- Folding Cartons

- Corrugated Boxes

- Others

By End-user

- Food

- Beverage

- Healthcare

- Personal Care

- Electrical

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Paper and Paperboard Packaging Market

5.1. COVID-19 Landscape: Paper and Paperboard Packaging Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Paper and Paperboard Packaging Market, By Product Type

8.1. Paper and Paperboard Packaging Market Revenue and Volume, by Product Type, 2023-2032

8.1.1. Folding Cartons

8.1.1.1. Market Revenue and Volume Forecast (2020-2032)

8.1.2. Corrugated Boxes

8.1.2.1. Market Revenue and Volume Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 9. Global Paper and Paperboard Packaging Market, By End-user

9.1. Paper and Paperboard Packaging Market Revenue and Volume, by End-user, 2023-2032

9.1.1. Food

9.1.1.1. Market Revenue and Volume Forecast (2020-2032)

9.1.2. Beverage

9.1.2.1. Market Revenue and Volume Forecast (2020-2032)

9.1.3. Healthcare

9.1.3.1. Market Revenue and Volume Forecast (2020-2032)

9.1.4. Personal Care

9.1.4.1. Market Revenue and Volume Forecast (2020-2032)

9.1.5. Electrical

9.1.5.1. Market Revenue and Volume Forecast (2020-2032)

9.1.6. Other

9.1.6.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 10. Global Paper and Paperboard Packaging Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.1.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.1.3.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.1.4.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.2.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.2.3.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.2.4.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.2.5.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.2.6.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.3.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.3.3.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.3.4.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.3.5.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.3.6.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.4.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.4.3.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.4.4.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.4.5.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.4.6.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.5.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.5.3.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Volume Forecast, by Product Type (2020-2032)

10.5.4.2. Market Revenue and Volume Forecast, by End-user (2020-2032)

Chapter 11. Company Profiles

11.1. International Paper Company

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. WestRock Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Smurfit Kappa Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Mondi Group

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. DS Smith Plc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Georgia-Pacific LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Tetra Pak International S.A.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Amcor plc

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Sonoco Products Company

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sealed Air Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/