Key Takeaways

- North America dominated the organic peroxide market with a 40% share in 2023.

- Asia-Pacific is expected to witness growth at a CAGR of 7.8% during the forecast period.

- By product, the diacetyl peroxide segment held the largest share of 41% in the market in 2023.

- By product, the ketone peroxide segment is expected to grow at a significant rate of 6.7% during the forecast period.

- By application, the paper and textiles segment held the largest share of 36% in the market.

- By application, the polymer segment is expected to grow at a notable rate of 7.3% during the forecast period.

The global organic peroxide market has witnessed significant growth in recent years, driven by the increasing demand from various end-use industries such as plastics, textiles, and chemicals. Organic peroxides are versatile chemical compounds known for their use as initiators in polymerization processes and as cross-linking agents. Their applications range from the production of polymer resins to the synthesis of specialty chemicals. The market’s expansion is fueled by the booming polymer industry, where organic peroxides play a crucial role in the production of polymers like polyethylene and polypropylene.

Get a Sample: https://www.precedenceresearch.com/sample/3748

Growth Factors

One of the primary growth factors for the organic peroxide market is the escalating demand for polymers across the globe. The automotive, construction, and packaging industries, among others, heavily rely on polymers, propelling the need for organic peroxides in polymerization processes. Additionally, advancements in polymer technology and the development of high-performance polymers are contributing to the increased consumption of organic peroxides.

The emphasis on sustainable and eco-friendly products is another growth factor for the organic peroxide market. With an increasing focus on green and bio-based polymers, organic peroxides are gaining popularity for their role in the production of environmentally friendly plastics. This shift towards sustainability is driving research and development efforts to enhance the efficiency and eco-friendliness of organic peroxides.

Organic Peroxide Market Scope

| Report Coverage | Details |

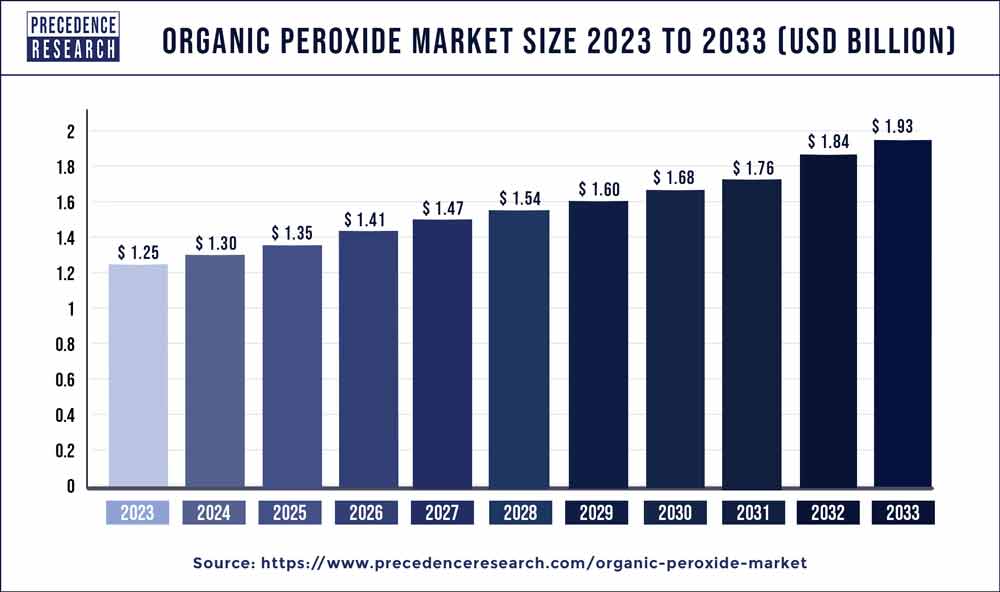

| Global Market Size in 2023 | USD 1.25 Billion |

| Global Market Size by 2033 | USD 1.93 Billion |

| U.S. Market Size in 2023 | USD 350 Million |

| U.S. Market Size by 2033 | USD 550 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In October 2022, Arkema (France) expanded its partnership with Univar Solutions, Weber & Schaer, and Dolder for the distribution of its organic peroxides. Arkema intended to expand its business in the European plastics cross-linking and rubber markets, and meet customer needs globally.

- In October 2022, Arkema (France) declared that the company would reorganize the distribution of its Luperox and Retic organic peroxide, with Weber and Schaer, The Dolder firm, and Univar Solutions, for the crosslinking market in several European countries as of January 1st, 2023.

- In June 2020, Nouryon (Netherlands) completed the expansion of organic peroxide in Brazil. The expansion has doubled the capacity of the manufacturing facility.

Organic Peroxide Market Dynamics

Drivers:

The automotive industry’s robust growth serves as a significant driver for the organic peroxide market. The demand for lightweight materials and high-performance plastics in automotive manufacturing has surged, boosting the use of organic peroxides in polymer production. These compounds contribute to the development of durable and lightweight components, addressing the industry’s evolving needs.

Furthermore, the expanding construction sector is a key driver for organic peroxide consumption. Polymer-based materials find extensive use in construction applications due to their durability and versatility. Organic peroxides are instrumental in the production of these construction materials, supporting the market’s growth.

Restraints:

Despite the positive momentum, the organic peroxide market faces challenges, including stringent regulations regarding the handling and transportation of these hazardous chemicals. Safety concerns associated with the storage and usage of organic peroxides pose a restraint, leading to increased compliance requirements and costs for manufacturers. Additionally, the volatility in raw material prices can impact the overall production costs, affecting market dynamics.

The market’s susceptibility to economic fluctuations is another restraint. During economic downturns, industries such as construction and automotive, which are major consumers of organic peroxides, may experience a slowdown, directly impacting the demand for these compounds.

Opportunity:

The growing emphasis on healthcare and medical applications presents a significant opportunity for the organic peroxide market. Organic peroxides are increasingly used in the production of medical-grade polymers and specialty chemicals. The healthcare sector’s demand for high-performance and biocompatible materials provides a promising avenue for the market’s expansion.

Moreover, the Asia-Pacific region offers substantial growth opportunities for organic peroxide manufacturers. The region’s rapid industrialization, coupled with the thriving automotive and construction sectors, creates a robust demand for polymers and, consequently, organic peroxides. Strategic investments and partnerships in this region can prove beneficial for companies looking to capitalize on emerging opportunities.

Read Also: Internet Data Center Market Size Will be USD 138.80 Bn by 2033

Organic Peroxide Market Companies

Sustainability initiatives are becoming increasingly important. Major players are investing in eco-friendly production processes, reducing waste generation, and exploring greener alternatives in response to growing environmental concerns. A few of these prominent players are:

- Akzo Nobel N.V. (Netherlands)

- Arkema S.A. (France)

- United Initiators (Germany)

- Nouryon (Netherlands)

- NOF Corporation (Japan)

- Pergan GmbH (Germany)

- Lanzhou Auxiliary Agent Plant Co., Ltd. (China)

- Solvay SA (Belgium)

- Chinasun Specialty Products Co., Ltd. (China)

- Hansoo Chemical Co., Ltd. (South Korea)

- Shaoxing Shangyu Shaofeng Chem Co., Ltd. (China)

- Jiangsu Yuanyang Pharmaceutical Co., Ltd. (China)

- MEGA S.p.A. (Italy)

- Plasti Pigments Pvt. Ltd. (India)

- NOF Europe GmbH (Germany)

Segments Covered in the Report

By Product

- Diacyl peroxide

- Ketone peroxide

- Percarbonates

- Dialkyl peroxide

- Hydro-peroxide

- Peroxy ketals

- Peroxyesters

By Application

- Polymer

- Chemicals & plastics

- Coatings, adhesives & elastomers

- Paper & textiles

- Detergents

- Personal care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/