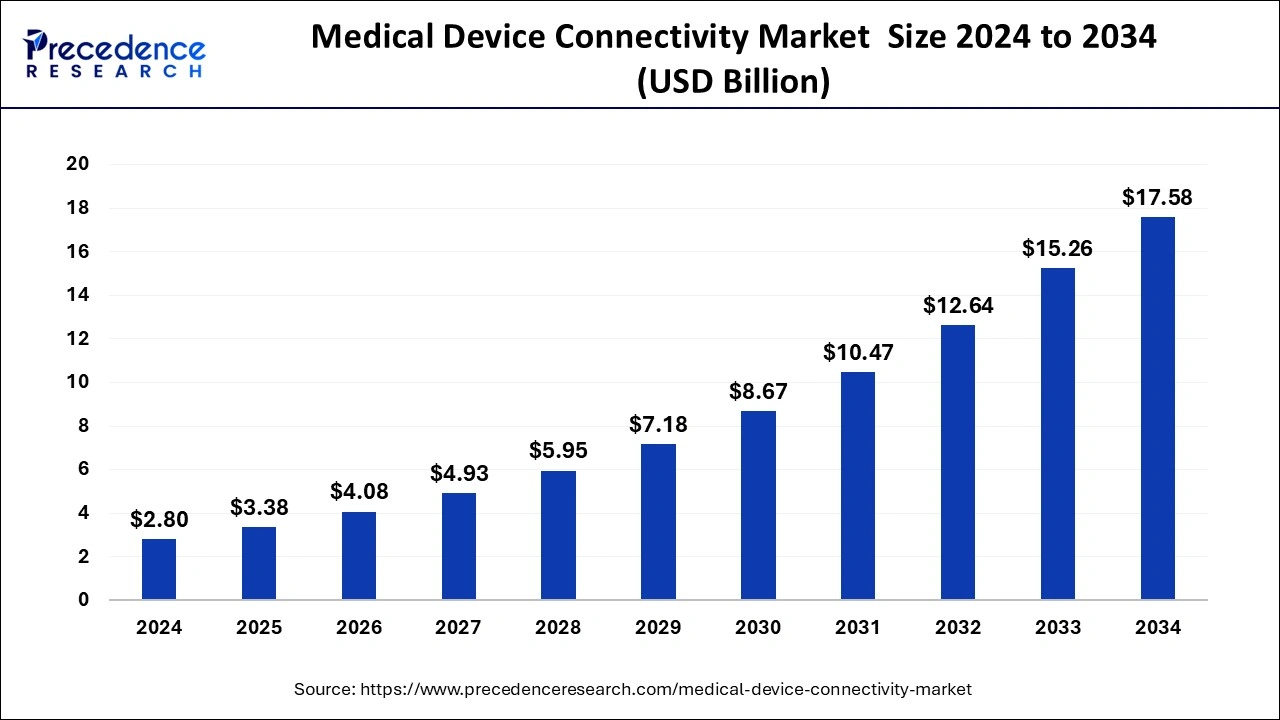

The global medical device connectivity market size accounted for USD 2.32 billion in 2023 and is estimated to attain around USD 15.26 billion by 2033, growing at a CAGR of 20.74% from 2024 to 2033.

Key Points

- North America has contributed 36% of market share in 2023.

- Asia Pacific is estimated to expand the fastest CAGR of 25.7% between 2024 and 2033.

- By components, in 2023, the wireless segment held the highest market share of 48%.

- By components, the wired segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

- By application, the hospitals segment has held the biggest market share in 2023.

- By application, the ambulatory care centers segment is anticipated to witness significant growth over the projected period.

The medical device connectivity market has witnessed significant growth in recent years, driven by the increasing adoption of healthcare information technology solutions and the growing need for integrated patient data management systems. Medical device connectivity refers to the ability of medical devices to securely connect and exchange data with healthcare information systems, such as electronic health records (EHR) systems and hospital information systems (HIS). This connectivity enables healthcare providers to remotely monitor patients, streamline workflows, improve clinical decision-making, and enhance patient outcomes. With the rising emphasis on digitization and interoperability in healthcare, the demand for medical device connectivity solutions is expected to continue to surge in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/3996

Growth Factors:

Several factors contribute to the growth of the medical device connectivity market. One of the primary drivers is the increasing prevalence of chronic diseases, such as cardiovascular disorders, diabetes, and respiratory illnesses. As the incidence of these conditions rises globally, there is a growing need for remote patient monitoring and real-time data analysis, which can be facilitated through medical device connectivity solutions. Moreover, the aging population and the associated rise in healthcare expenditure are fueling the demand for advanced medical technologies that improve patient care and operational efficiency.

Another key growth factor is the rapid advancement of wireless communication technologies and the Internet of Things (IoT). The proliferation of connected medical devices, including wearable sensors, implantable devices, and mobile health apps, has expanded the scope of medical device connectivity. These technologies enable seamless data transmission, interoperability, and remote monitoring, empowering healthcare providers to deliver more personalized and proactive care.

Furthermore, government initiatives aimed at promoting healthcare IT adoption and interoperability standards are driving market growth. Regulatory bodies and healthcare organizations worldwide are implementing policies and guidelines to incentivize the integration of medical devices with electronic health records and other healthcare information systems. For instance, the Centers for Medicare & Medicaid Services (CMS) in the United States has introduced programs such as the Promoting Interoperability (formerly Meaningful Use) initiative, which encourages healthcare providers to adopt certified EHR technology and utilize it for data exchange and care coordination.

Region Insights:

The medical device connectivity market exhibits regional variations in terms of adoption rates, regulatory landscape, and technological infrastructure. North America holds a significant share of the global market, driven by the presence of advanced healthcare IT infrastructure, favorable government initiatives, and a large base of healthcare providers embracing digital health solutions. The region is home to leading medical device connectivity solution providers and enjoys robust support from regulatory agencies such as the Food and Drug Administration (FDA) and the Office of the National Coordinator for Health Information Technology (ONC).

Europe is also a prominent market for medical device connectivity, propelled by increasing healthcare digitization efforts, interoperability initiatives, and investments in telehealth and remote monitoring technologies. Countries like Germany, the UK, and France are at the forefront of adopting connected medical devices and implementing standards for data exchange and integration across healthcare settings.

Asia Pacific is expected to witness rapid growth in the medical device connectivity market, fueled by the expanding healthcare infrastructure, rising healthcare IT investments, and growing awareness about the benefits of digital health solutions. Emerging economies such as China, India, and Japan are investing heavily in healthcare technology modernization, driving the demand for medical device connectivity solutions to support remote patient monitoring, telemedicine, and data-driven healthcare delivery models.

Medical Device Connectivity Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 20.74% |

| Global Market Size in 2023 | USD 2.32 Billion |

| Global Market Size by 2033 | USD 15.26 Billion |

| U.S. Market Size in 2023 | USD 580 Million |

| U.S. Market Size by 2033 | USD 3,850 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Components and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Medical Device Connectivity Market Dynamics

Drivers:

Several factors are driving the adoption of medical device connectivity solutions in healthcare settings. One of the primary drivers is the need for real-time patient monitoring and clinical decision support. Medical device connectivity enables healthcare providers to access timely and accurate patient data, facilitating early detection of adverse events, proactive intervention, and personalized treatment planning. This leads to improved clinical outcomes, reduced hospital readmissions, and enhanced patient satisfaction.

Another driver is the shift towards value-based care and population health management. Healthcare organizations are increasingly focusing on preventive care, care coordination, and chronic disease management to improve patient health outcomes and reduce healthcare costs. Medical device connectivity plays a crucial role in supporting these initiatives by enabling remote monitoring of patients with chronic conditions, facilitating care coordination among multidisciplinary teams, and leveraging data analytics for risk stratification and predictive modeling.

Moreover, the growing adoption of telemedicine and remote patient monitoring solutions is driving the demand for medical device connectivity. Telehealth technologies allow patients to receive medical care and consultations remotely, eliminating the need for in-person visits and reducing healthcare disparities, especially in underserved areas. Medical device connectivity enables the seamless integration of remote monitoring devices, such as wearables, sensors, and home-based medical devices, with telemedicine platforms, enabling healthcare providers to remotely assess patient health status, track vital signs, and adjust treatment plans as needed.

Opportunities:

The medical device connectivity market presents several opportunities for innovation and growth. One of the key opportunities lies in the development of interoperable and vendor-agnostic connectivity solutions. As healthcare organizations adopt a wide range of medical devices from different manufacturers, interoperability becomes crucial for seamless data exchange and integration across disparate systems. Companies that can offer interoperable connectivity platforms and solutions that support multiple device types and standards stand to gain a competitive advantage in the market.

Another opportunity lies in expanding the use of medical device connectivity beyond acute care settings to encompass home healthcare, ambulatory care, and remote monitoring applications. With the rise of connected health devices and mobile health apps, there is a growing demand for solutions that enable continuous monitoring and management of patients outside traditional healthcare facilities. Companies that can develop user-friendly, scalable, and cost-effective connectivity solutions for remote patient monitoring and telehealth services are well-positioned to capitalize on this trend.

Furthermore, there is an opportunity for collaboration and partnerships among healthcare stakeholders, including medical device manufacturers, software developers, healthcare providers, and regulatory agencies. By working together to define interoperability standards, address cybersecurity concerns, and develop integrated solutions, stakeholders can accelerate the adoption of medical device connectivity and drive innovation in healthcare delivery and patient care.

Restraints:

Despite the promising growth prospects, the medical device connectivity market faces certain challenges and restraints. One of the primary restraints is the complexity of integrating diverse medical devices and IT systems within healthcare organizations. Achieving seamless interoperability and data exchange across different platforms, protocols, and standards requires significant technical expertise, resources, and investment. Moreover, legacy systems and proprietary technologies present interoperability challenges, hindering the implementation of unified connectivity solutions.

Another restraint is the concerns related to data security and privacy. As medical devices become increasingly connected and networked, they become vulnerable to cybersecurity threats, such as data breaches, malware attacks, and unauthorized access. Protecting patient health information and ensuring the confidentiality, integrity, and availability of data are paramount concerns for healthcare organizations and regulatory agencies. Addressing these security challenges requires robust cybersecurity measures, encryption protocols, access controls, and compliance with data protection regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe.

Additionally, regulatory compliance and certification requirements pose challenges for medical device manufacturers and software vendors. Ensuring that medical devices and connectivity solutions meet regulatory standards for safety, performance, and interoperability entails rigorous testing, documentation, and validation processes. Delays in obtaining regulatory approvals or certifications can impede product launches and market entry, limiting the growth potential of companies in the medical device connectivity market.

Read Also: Cord Blood Banking Market Size to Attain USD 27.55 Bn by 2033

Recent Developments

- In October 2023, Philips unveiled new interoperability features aimed at providing hospitals with a comprehensive patient health overview for enhanced monitoring and care coordination. By integrating Philips Capsule Medical Device Information Platform (MDIP) with Philips Patient Information Center iX (PIC iX), the company offers a unique patient monitoring ecosystem, bringing together diverse medical devices and systems onto a single interface. This interoperability allows clinicians to access streaming data from various device manufacturers on an open, secure platform, offering a new clinical perspective.

- In February 2023, the province of Nova Scotia collaborated with Nova Scotia Health Authority (NSHA) and IWK Health (IWK) to implement an integrated electronic care record system across the province, facilitated by Oracle Cerner. This technology aims to improve healthcare professionals’ access to patient information.

- In 2021, Koninklijke Philips N.V. entered into an agreement to acquire Capsule Technologies Inc., a leading provider of medical device integration and data technologies to healthcare organizations. This strategic move was intended to bolster Philips’ position in delivering connectivity solutions for patient care management within hospital settings.

- In 2021, Masimo Corporation introduced iSirona, a connectivity solution designed to integrate with electronic medical records (EMRs), surveillance monitoring, alarm management, mobile notifications, smart displays, and analytics.

Medical Device Connectivity Market Companies

- Cerner Corporation (U.S.)

- Medtronic (Ireland)

- Masimo (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- General Electric (U.S.)

- Stryker (U.S.)

- iHealth Labs Inc., (U.S.)

- Cisco Systems, Inc. (U.S.)

- Lantronix Inc. (U.S.)

- Infosys Limited (India)

- Silicon & Software Systems Ltd. (Ireland)

- Hill-Rom Services Inc. (U.S.)

- Silex Technology America, Inc (Japan)

- Digi International Inc. (U.S.)

- Baxter (U.S.)

- TE Connectivity (Switzerland)

- Bridge-Tech (U.S)

- MediCollector (U.S.)

Segments Covered in the Report

By Components

- Wireless

- Wired

- Hybrid Technologies

By Application

- Hospitals

- Home Healthcare Centers

- Diagnostic Centers

- Ambulatory Care Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/