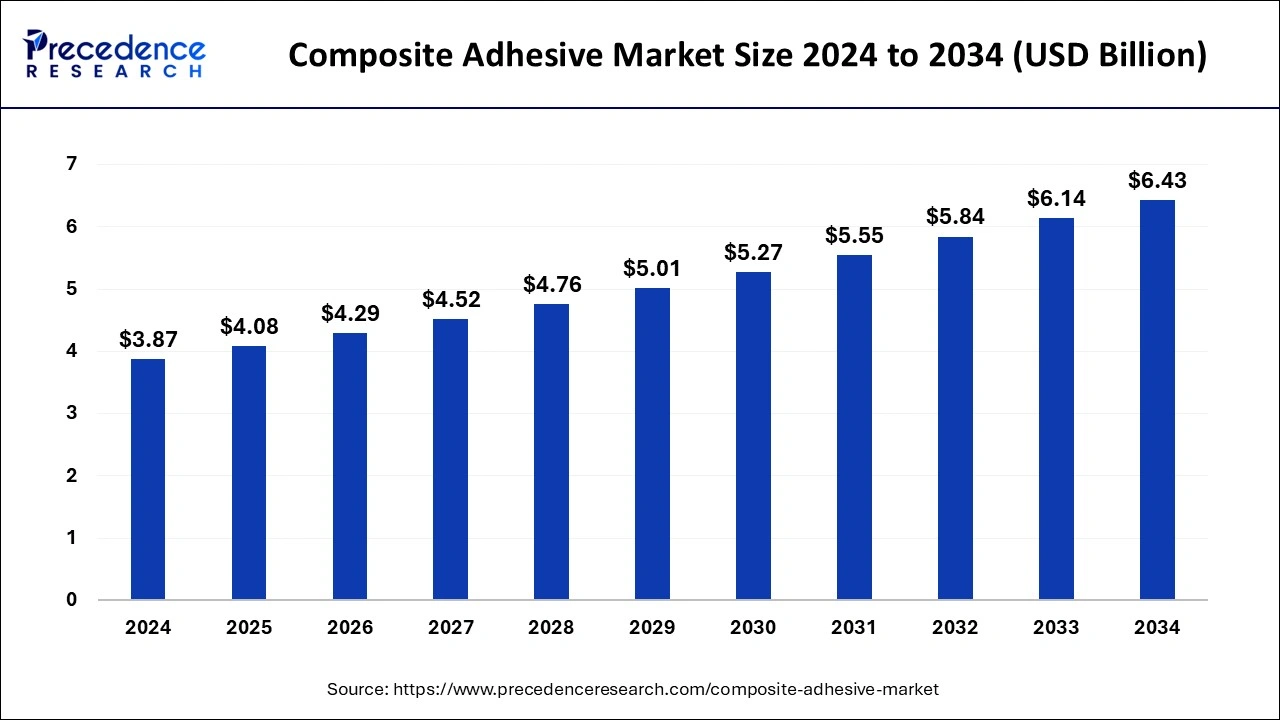

The global composite adhesive market size accounted for USD 3.68 billion in 2023 and is anticipated to rake around USD 6.14 billion by 2033, growing at a CAGR of 5.26% from 2024 to 2033.

Key Points

- Asia-Pacific dominated the market with the largest market share of 49% in 2023.

- North America is expected to be the fastest-growing region over the projected period.

- By product, the epoxy segment has contributed more than 37% of market share in 2023.

- By product, the polyurethane segment is expected to witness significant growth over the forecast period.

- By application, the aerospace and defense segment has held the largest market share of 19% in 2023.

- The automotive segment is likely to grow significantly in the upcoming years.

The composite adhesive market is a segment within the broader adhesives industry that specializes in providing bonding solutions for composite materials. Composite materials are engineered materials made from two or more constituent materials with significantly different physical or chemical properties. These materials are widely used across various industries, including aerospace, automotive, construction, marine, and wind energy, due to their lightweight, high strength, corrosion resistance, and other desirable properties. Composite adhesives play a crucial role in bonding these materials together, offering excellent adhesion, durability, and compatibility with different composite substrates.

Get a Sample: https://www.precedenceresearch.com/sample/4037

Growth Factors:

The composite adhesive market has experienced steady growth in recent years, driven by several key factors. One of the primary growth drivers is the increasing demand for lightweight materials in various industries. Composite materials offer a high strength-to-weight ratio, making them ideal for applications where weight reduction is critical, such as in the aerospace and automotive sectors. As a result, there is a growing need for advanced adhesive solutions that can effectively bond these lightweight composites while maintaining structural integrity and performance.

Another significant factor driving the growth of the composite adhesive market is the expanding use of composites in infrastructure and construction projects. Composite materials are being increasingly utilized in the construction of bridges, buildings, and other structures due to their durability, corrosion resistance, and design flexibility. This trend creates opportunities for adhesive manufacturers to develop specialized bonding solutions tailored to the unique requirements of the construction industry.

Additionally, the growing emphasis on sustainability and environmental regulations is driving the demand for eco-friendly adhesive formulations. Many composite adhesive manufacturers are investing in research and development to create products that are free from harmful chemicals, volatile organic compounds (VOCs), and other environmentally damaging substances. These eco-friendly adhesives not only meet regulatory requirements but also appeal to environmentally conscious consumers and businesses.

Region Insights:

The composite adhesive market exhibits a global presence, with significant demand emanating from key regions across the world. North America, Europe, Asia Pacific, and the rest of the world are the primary regions contributing to the market’s growth.

North America holds a prominent position in the composite adhesive market, driven by the presence of a robust aerospace and automotive industry. The region’s stringent regulatory standards regarding emissions and safety further fuel the demand for high-performance composite adhesives. Additionally, increased investments in infrastructure projects, particularly in the United States, are expected to boost market growth in the region.

Europe is another key market for composite adhesives, with countries like Germany, France, and the United Kingdom leading the demand. The region’s strong manufacturing base, particularly in automotive and wind energy sectors, drives the adoption of composite materials and corresponding adhesive solutions. Stringent environmental regulations in Europe also promote the use of eco-friendly adhesives, further stimulating market growth.

In the Asia Pacific region, rapid industrialization, urbanization, and infrastructure development are driving the demand for composite adhesives. Countries like China, Japan, and India are witnessing significant investments in aerospace, automotive, and construction sectors, creating opportunities for adhesive manufacturers. Moreover, the increasing adoption of composite materials in emerging economies for lightweighting and energy efficiency purposes contributes to market expansion in the region.

Composite Adhesive Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.26% |

| Global Market Size in 2023 | USD 3.68 Billion |

| Global Market Size by 2033 | USD 6.14 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Composite Adhesive Market Dynamics

Drivers:

Several key drivers propel the growth of the composite adhesive market. One of the primary drivers is the increasing demand for lightweight materials across various industries. Industries such as aerospace, automotive, and wind energy are continuously seeking ways to reduce weight while maintaining structural integrity and performance. Composite materials, bonded together using advanced adhesives, offer a compelling solution to meet this demand.

Furthermore, the growing emphasis on sustainability and environmental regulations is driving the adoption of eco-friendly adhesive formulations. Manufacturers are investing in research and development to create adhesives that are free from harmful chemicals and comply with stringent environmental standards. This shift towards sustainable adhesives not only addresses regulatory requirements but also aligns with the preferences of environmentally conscious consumers and businesses.

Another driver of market growth is the expanding use of composites in construction and infrastructure projects. Composite materials offer several advantages over traditional materials, including durability, corrosion resistance, and design flexibility. As a result, there is a growing demand for composite adhesives that can effectively bond these materials together in various construction applications, such as bridges, buildings, and pipelines.

Moreover, advancements in adhesive technologies, such as improved bonding strength, faster curing times, and enhanced durability, are driving market growth. Manufacturers are continually innovating to develop adhesives that meet the evolving needs of end-users across different industries. These technological advancements enable the adoption of composite materials in a wider range of applications, further fueling market expansion.

Opportunities:

The composite adhesive market presents several opportunities for growth and innovation. One of the key opportunities lies in the development of specialized adhesive formulations tailored to specific end-use applications. Industries such as aerospace, automotive, and marine have unique bonding requirements, including high temperature resistance, chemical compatibility, and long-term durability. By focusing on these niche markets and offering customized adhesive solutions, manufacturers can capitalize on emerging opportunities and gain a competitive edge.

Additionally, there is a growing demand for bio-based and renewable adhesives in the composite adhesive market. With increasing awareness of environmental issues and sustainability concerns, there is a shift towards eco-friendly adhesive formulations derived from renewable sources such as plant-based resins, starches, and sugars. Manufacturers have the opportunity to innovate and develop bio-based adhesives that offer comparable performance to traditional petroleum-based adhesives while reducing environmental impact.

Furthermore, the expansion of the composites industry into new applications and markets presents opportunities for adhesive manufacturers. Industries such as renewable energy, electronics, sporting goods, and medical devices are increasingly incorporating composite materials into their products. By developing adhesive solutions that cater to these emerging markets and applications, manufacturers can diversify their product portfolios and tap into new revenue streams.

Moreover, partnerships and collaborations between adhesive manufacturers and composite material suppliers can drive innovation and market growth. By working together to develop integrated solutions that combine advanced materials and adhesive technologies, companies can address complex bonding challenges and create value-added products for customers. Strategic alliances also enable manufacturers to leverage each other’s expertise, resources, and distribution networks to expand their market presence and reach new customers.

Challenges:

Despite the promising growth prospects, the composite adhesive market faces several challenges that may hinder its expansion. One of the primary challenges is the high cost of advanced adhesive formulations. Developing and manufacturing specialized adhesives with superior performance characteristics often requires significant investment in research, development, and production facilities. As a result, the cost of these adhesives may be higher compared to conventional alternatives, which could limit their adoption, particularly in cost-sensitive industries.

Another challenge is the complexity of bonding composite materials with diverse properties and surface characteristics. Unlike traditional materials such as metals and plastics, composite materials often have heterogeneous surfaces with varying degrees of porosity, roughness, and chemical composition. Achieving strong and durable bonds between dissimilar materials can be challenging and may require specialized surface preparation techniques, adhesive formulations, and curing processes.

Furthermore, the regulatory landscape governing the use of adhesives in different industries is constantly evolving, posing compliance challenges for manufacturers. Adhesive formulations may need to meet stringent requirements regarding emissions, toxicity, and workplace safety, which can vary across regions and applications. Keeping up with these regulatory changes and ensuring compliance can be time-consuming and resource-intensive for adhesive manufacturers, particularly those operating in multiple markets.

Additionally, the competitive landscape of the composite adhesive market is becoming increasingly crowded, with numerous players vying for market share. This intensifying competition puts pressure on manufacturers to differentiate their products through innovation, quality, and customer service. Companies that fail to keep pace with technological advancements or meet customer expectations may struggle to maintain their competitive position and profitability in the market.

Moreover, the volatility of raw material prices and supply chain disruptions pose additional challenges for adhesive manufacturers. Many adhesive formulations rely on petrochemical-based raw materials, the prices of which are subject to fluctuations due to factors such as geopolitical tensions, supply-demand dynamics, and currency fluctuations. Furthermore, disruptions in the supply chain, such as natural disasters, trade disputes, and transportation issues, can impact the availability and cost of raw materials, potentially affecting production schedules and profitability.

Read Also: Modular Construction Market Size to Worth USD 201.31 Bn by 2033

Recent Developments

- In February 2023, Henkel AG & Co. KGaA announced a collaboration with the International Centre for Industrial Transformation’s participation program. The business’s adhesive technologies business department wants to employ INCIT’s tools and frameworks to accelerate its processes’ digital transformation by joining INCIT’s partner network.

- In March 2022, 3M, a diversified technology business, introduced their new Scotch-Weld Multi-Material Composite Urethane Adhesive DP6310NS. This glue is intended to attach a variety of composite components and has good impact resistance and durability.

- In February 2022, Arkema completed its acquisition of Ashland’s Performance Adhesives division. Structural adhesives are among the products available in this area. The acquisition was worth USD 1.65 billion. The acquisition bolstered Arkema’s Adhesive Solutions sector and was in line with the company’s objective of becoming a pure specialty material provider by 2024.

Composite Adhesive Market Companies

- 3M

- Bostik

- Dow

- Henkel AG & Co. KGaA

- H.B. Fuller

- Huntsman International LLC.

- Illinois Tool Works Inc.

- Permabond LLC

- Parker Hannifin Corp

- Sika AG

Segments Covered in the Report

By Product

- Acrylic

- Epoxy

- Polyurethane

- Cyanoacrylate

- Others

By Applications

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Construction & Infrastructure

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/