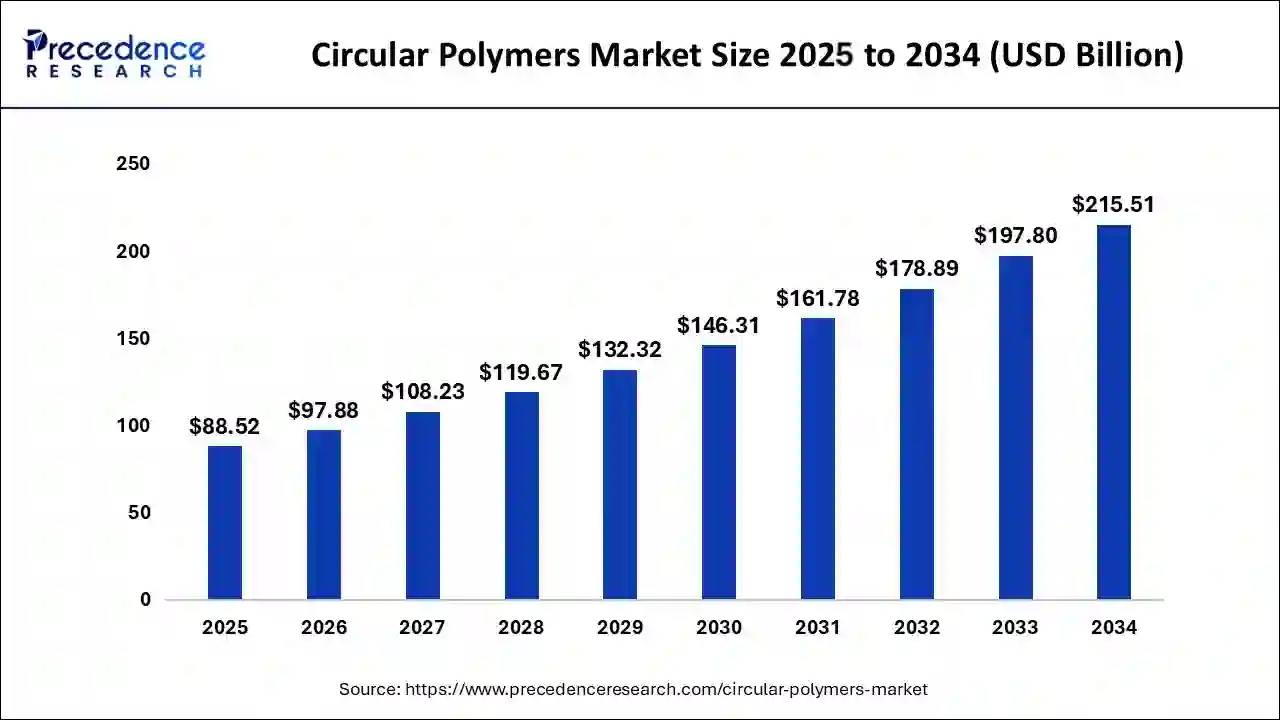

The global circular polymers market size accounted for USD 72.40 billion in 2023 and is expected to attain around USD 197.80 billion by 2033, growing at a CAGR of 10.57% from 2024 to 2033.

Key Points

- In 2023, Asia Pacific dominated the circular polymers market with a market share of 47%.

- North America is expected to secure a significant portion of the market’s revenue in the upcoming years.

- By polymer type, the polyethylene (PE) segment has dominated the market in 2023 with a market share of 33%.

- By form, in 2023, the pellets segment has accounted largest market share of around 54%.

- By form, the flakes segment has captured a market share of around 46% in 2023.

- By application, the food packaging segment dominated the market of circular polymers in 2023 with a 44% revenue share.

- By end use, the packaging segment captured a market share of 54% in 2023.

The circular polymers market is an emerging sector that focuses on recycling and reusing plastic materials to create new products, thereby minimizing waste and environmental impact. As sustainability becomes an increasingly important aspect of industry practices, circular polymers offer a way to extend the life cycle of plastic materials. This market encompasses various processes such as mechanical and chemical recycling, and biodegradable polymers.

Growth Factors

Several factors are driving the growth of the circular polymers market. Firstly, increased environmental awareness has led to stricter regulations regarding plastic waste management. This, in turn, has encouraged the adoption of circular economy principles in the polymer industry. Additionally, consumer demand for sustainable products is on the rise, pushing companies to innovate in the production of recycled and biodegradable plastics.

Get a Sample: https://www.precedenceresearch.com/sample/4092

Region Insights

The market for circular polymers is experiencing growth across various regions, including North America, Europe, and Asia-Pacific. Europe is a leading region due to stringent environmental regulations and strong commitments to sustainability. North America is also seeing significant growth, driven by increasing investments in recycling infrastructure. Meanwhile, Asia-Pacific is emerging as a key market due to the presence of a large manufacturing sector and government initiatives promoting recycling.

Circular Polymers Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.57% |

| Global Market Size in 2023 | USD 72.40 Billion |

| Global Market Size in 2024 | USD 80.05 Billion |

| Global Market Size by 2033 | USD 197.80 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Polymer Type, By Form, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Circular Polymers Market Dynamics

Drivers

Key drivers for the circular polymers market include rising environmental concerns and the need to comply with regulatory requirements. Governments worldwide are implementing policies to curb plastic waste, leading to increased investment in recycling technologies. Moreover, companies are recognizing the economic benefits of adopting circular practices, such as cost savings and the potential for new revenue streams from recycled materials.

Opportunities

There are numerous opportunities in the circular polymers market, particularly in the development of advanced recycling technologies and the production of high-quality recycled polymers. Additionally, partnerships between businesses and governments can lead to the creation of closed-loop systems, promoting sustainable supply chains. Innovation in biodegradable polymers is also a promising area, offering alternatives to traditional plastics.

Challenges

Despite the market’s potential, there are challenges to be addressed, including the need for improved recycling infrastructure and technology. Current recycling processes may be inefficient, leading to contamination and lower-quality recycled materials. Moreover, the cost of producing circular polymers can be higher compared to traditional polymers, posing a hurdle for wider adoption. Additionally, consumer awareness and education on the benefits of circular polymers need to be improved to drive demand.

Read Also: Smart Medical Devices Market Size to Attain USD 152.30 Bn by 2033

Recent Developments

- In September 2023, Chevron Phillips Chemical Company LLC collaborated with Danimer Scientific, formerly known as Meridian Holdings Group Inc., and MHG, a biopolymer manufacturer. This collaboration aimed to utilize Rinnovo polymers produced in a loop slurry reactor process to create biodegradable cast extrusion films, blown extrusion films, injection molded parts, and rational molded parts.

- In July 2023, TotalEnergies SE collaborated with Aramco, SABIC (Saudi Arabia Basic Industries Corporation), a chemical manufacturer. This collaboration aimed to convert oil derived from plastic waste into circular polymers.

- In June 2023, Circular Polymers by Ascend introduced Cerene, a line of recycled polymers and materials made from the company’s proprietary carpet reclaiming technology. The launched product would be available as polyamide 6 and 66, PET, polypropylene, and calcium carbonate as a consistent, sustainable feedstock for many applications consisting of molding and compounding.

- In June 2023, Borealis AG took over Rialti S.p.A., a polypropylene (PP) compounder of recyclates based in the Varese area of Italy. This acquisition aimed to expand Borealis’s PP compounding business and, in particular, increase its volume of PP compounds based on mechanical recyclates.

- In May 2023, Borealis AG launched Bornewables, a line of Queo, a range of plastomers and elastomers based on renewable feedstock. The launched product would allow Borealis to meet increasing customer demand for sustainable solutions that don’t compromise on quality or performance.

Circular Polymers Market Companies

- LyondellBasell Industries Holdings B.V.

- SABIC

- Ascend Performance Materials Operations, LLC

- Advanced Circular Polymers

- Borealis AG

- Veolia

- Exxon Mobil Corporation

- The Shakti Plastic Industries

- Chevron Phillips Chemical Company, LLC

- Suez Group

Segments Covered in the Report

By Polymer Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Others

By Form

- Pellets

- Flakes

By Application

- Food Packaging

- Adhesives & Sealants

- Interior & Exterior Components

- Wires & Cables

- Others

By End-use

- Packaging

- Building & Construction

- Automotive

- Electrical & Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/