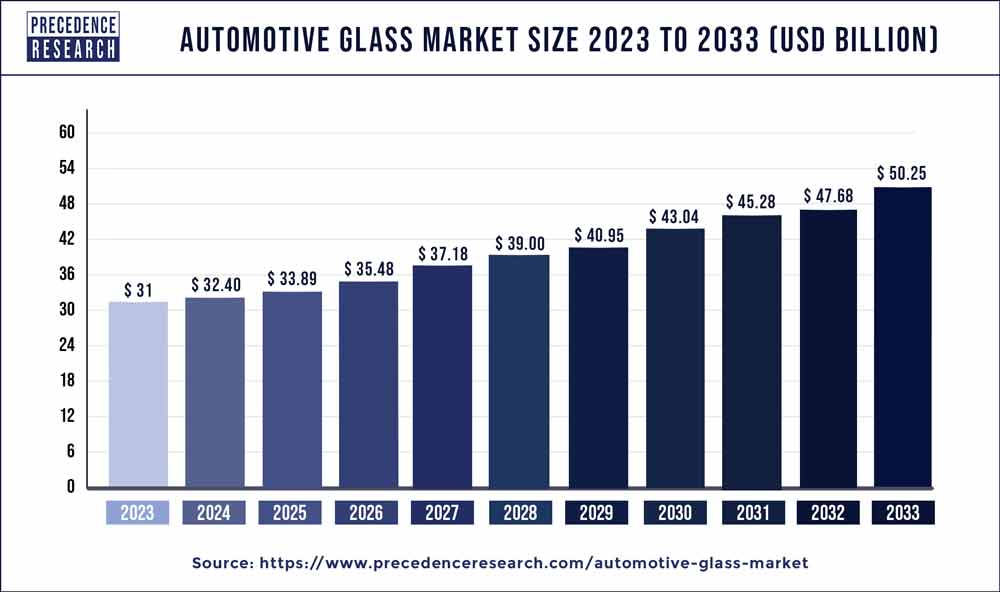

The global automotive glass market size reached USD 31 billion in 2023 and is projected to grow around USD 50.25 billion by 2033, growing at a CAGR of 5% from 2024 to 2033.

Key Takeaways

- Asia-Pacific contributed 55% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By product, the tempered glass segment held the largest market share of 60% in 2023.

- By product, the laminated glass segment is anticipated to grow at a remarkable CAGR of 7.3% between 2024 and 2033.

- By vehicle type, the passenger cars segment generated over 59% of the market share in 2023.

- By vehicle type, the light commercial vehicles segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the original equipment manufacturer (OEM) segment generated over 92% of the market share in 2023.

- By end-use, the aftermarket segment is expected to expand at the fastest CAGR over the projected period.

Introduction

The automotive glass market plays a pivotal role in the automotive industry, contributing significantly to the safety, aesthetics, and overall functionality of vehicles. Automotive glass encompasses various components, such as windshields, side windows, and rear windows, each serving distinct purposes. Over the years, advancements in technology and design have transformed automotive glass into a critical element, not only for protecting occupants but also for enhancing the vehicle’s overall appeal and energy efficiency.

Get a Sample: https://www.precedenceresearch.com/sample/3732

Growth Factors

Several key factors contribute to the growth of the automotive glass market. The increasing global demand for automobiles, coupled with a rising focus on safety and environmental considerations, has led to a surge in the adoption of advanced glass technologies. Innovations such as smart glass, which can adjust its transparency based on external conditions, and the integration of Heads-Up Display (HUD) systems are driving market expansion. Additionally, the growing trend towards electric and autonomous vehicles is creating new opportunities for automotive glass manufacturers, as these vehicles often require specialized glass solutions.

Automotive Glass Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5% |

| Global Market Size in 2023 | USD 31 Billion |

| Global Market Size by 2033 | USD 50.25 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Vehicle Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In May 2022, NSG Group revealed plans to integrate its automotive glass business in China with SYP Kangqiao Autoglass Co., Ltd., a leading Chinese automotive glass manufacturer. This strategic partnership with SYP Automotive is designed to bolster NSG Group’s capacity to meet the growing demands of car manufacturers in the Chinese market.

- In March 2022, LKQ Corporation finalized an agreement to divest PGW Auto Glass to One Equity Partners (OEP), a private equity firm. According to its website, PGW boasts an extensive network with over 100 distribution branches and a customer base exceeding 27,000 in both Canada and the United States.

- In February 2019, Vitro, a North American automotive glass manufacturer, committed a significant investment of USD 60 million toward the development and implementation of cutting-edge technologies. These investments were strategically directed at the North American market, with the goal of reinforcing Vitro’s prominent position in the automotive glass sector. The company aimed to strengthen its role as a premier supplier to original equipment manufacturers (OEMs) and aftermarket customers in the region.

Automotive Glass Market Dynamics

Drivers:

One of the primary drivers propelling the automotive glass market is the stringent safety regulations imposed by governments worldwide. The need for compliance with safety standards has led automakers to invest in high-quality glass materials that can withstand impact and contribute to occupant protection. Moreover, the aesthetic appeal of advanced glass features, such as panoramic sunroofs and frameless windows, is driving consumer preference, further boosting market growth.

Restraints

Despite the positive momentum, the automotive glass market faces challenges, including the high manufacturing costs associated with advanced glass technologies. Additionally, the increasing complexity of integrating smart glass features poses a barrier for some manufacturers. Economic uncertainties and fluctuations in raw material prices also contribute to restraining the market growth, affecting both production costs and profit margins.

Opportunity:

The automotive glass market presents a significant opportunity for innovation and collaboration. Continued advancements in glass manufacturing techniques and the development of eco-friendly materials offer avenues for growth. Furthermore, the rising demand for electric and autonomous vehicles opens up opportunities for the integration of cutting-edge glass technologies to enhance safety, comfort, and energy efficiency. Collaborations between automotive manufacturers and glass technology companies can play a pivotal role in capitalizing on these opportunities.

Automotive Glass Market Companies

- Asahi Glass Co., Ltd.

- Saint-Gobain S.A.

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Guardian Industries

- AGC Inc.

- Vitro S.A.B. de C.V.

- Xinyi Glass Holdings Limited

- Central Glass Co., Ltd.

- Shenzhen Benson Automobile Glass Co., Ltd.

- Pittsburgh Glass Works (PGW)

- Webasto SE

- Corning Incorporated

- SYP Kangqiao Autoglass Co., Ltd.

- Pilkington Group Limited

Segments Covered in the Report

By Product

- Tempered Glass

- Laminated Glass

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By End-use

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/