- Asia Pacific held the dominating share of the market of 47% in 2023.

- North America is observed to expand at a CAGR of 5.7% during the forecast period.

- By type, the LED lighting segment led the market with 32% of market share in 2023.

- By type, the halogen lighting segment is expected to witness a rapid growth with a CAGR of 4.9% over the forecast period.

- By application, the general lighting segment dominated the market with 41% of market share in 2023.

- By application, the automotive segment is expected to witness a significant growth rate of 5.6% during the forecast period.

- By end user, the residential segment held the dominating share of 54% in 2023.

- On the other hand, the commercial segment is expected to witness the fastest rate of growth at 3.9% during the forecast period.

The Artificial Lights Market has witnessed substantial growth in recent years, driven by the increasing adoption of smart lighting solutions, advancements in LED technology, and the growing awareness of energy efficiency. Artificial lights play a pivotal role in various sectors, including residential, commercial, industrial, and public spaces. The market encompasses a wide range of products, from traditional incandescent bulbs to cutting-edge smart lighting systems that are integrated with IoT (Internet of Things) technology. As societies transition towards more sustainable and energy-efficient practices, the demand for innovative artificial lighting solutions is on the rise.

Get a Sample: https://www.precedenceresearch.com/sample/3756

Growth Factors

Several factors contribute to the robust growth of the Artificial Lights Market. One of the key drivers is the rapid technological advancements in LED lighting. LED lights offer higher energy efficiency, longer lifespan, and better light quality compared to traditional lighting solutions. The increasing awareness of environmental issues and the need for energy conservation has led to a surge in the adoption of LED lights across residential, commercial, and industrial sectors.

Moreover, the integration of smart lighting systems with IoT technology is a significant growth factor. Smart lighting allows users to control and automate lighting settings, leading to enhanced energy savings and personalized user experiences. The expanding trend of smart homes and smart cities further propels the demand for intelligent lighting solutions.

The emphasis on sustainable and eco-friendly practices is another driving force. Governments and organizations worldwide are implementing regulations and initiatives to promote energy-efficient lighting solutions, fostering the growth of the market. The rising demand for aesthetically pleasing lighting designs in architectural and interior applications also contributes to the market expansion.

Artificial Lights Market Scope

| Report Coverage | Details |

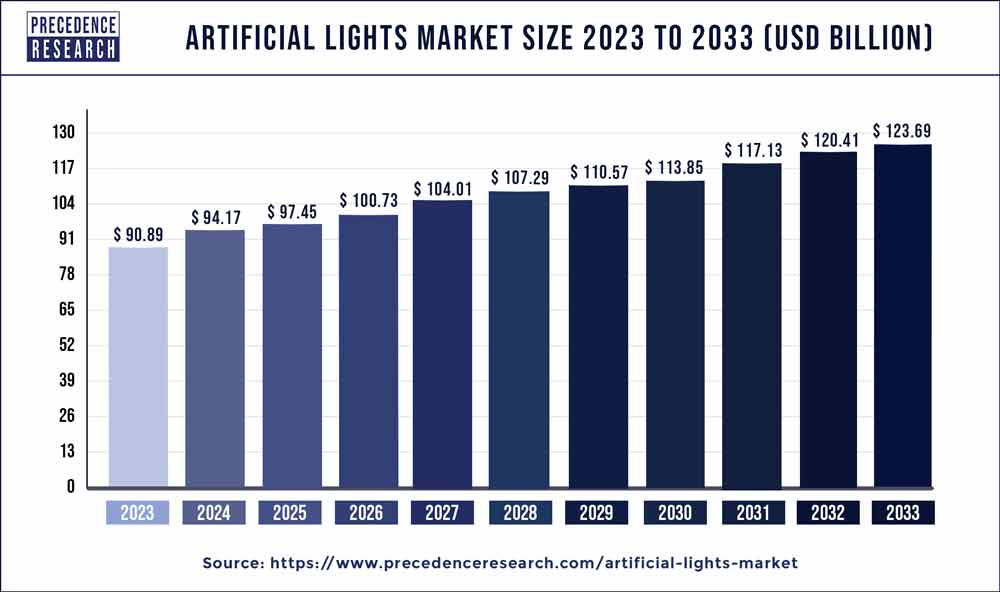

| Global Market Size in 2023 | USD 90.89 Billion |

| Global Market Size by 2033 | USD 123.69 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.08% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In February 2023, OSRAM GmbH (ams OSRAM AG), a prominent provider of optical solutions leveraging edge-emitting lasers (EELs) and vertical-cavity surface-emitting lasers (VCSELs) technology, revealed a collaboration with Cepton to deliver light detection and ranging (LiDAR) solutions for autonomous vehicles.

- In February 2022, GE Current, a US-based lighting firm, acquired Hubbell C&I Lighting, also based in the US, for an undisclosed sum. This acquisition aims to improve both companies’ distribution networks and digital capabilities, enabling them to better address customer requirements with increased speed, efficiency, and convenience. Hubbell C&I Lighting specializes in general lighting solutions.

- In December 2021, Signify N.V. disclosed the acquisition of Fluence, a move aimed at expanding and enriching its agricultural lighting growth platform.

- In January 2021, Ushio Deutschland GmbH, the German branch of Ushio Europe, completed a merger with BLV Licht- und Vakuumtechnik GmbH, its sister company known for manufacturing horticultural lighting systems. Following the merger, the combined entity operates under the name Ushio Germany GmbH. Ushio Europe specializes in producing UV, visible, and infrared lighting solutions, boasting manufacturing and testing facilities.

Artificial Lights Market Dynamics

Drivers:

Several drivers propel the Artificial Lights Market forward. The increasing urbanization and population growth lead to higher demand for lighting solutions in residential and commercial spaces. The need for energy-efficient lighting in these settings, combined with the desire for advanced features like color control and remote access, drives the adoption of artificial lights.

Government initiatives promoting energy efficiency and sustainable practices play a crucial role as well. Subsidies, tax incentives, and regulations favoring the use of energy-efficient lighting solutions encourage both consumers and businesses to invest in artificial lights that contribute to reduced energy consumption and lower carbon footprints.

Additionally, the declining cost of LED technology and the increasing affordability of smart lighting systems make these solutions more accessible to a broader consumer base. This affordability factor is a significant driver, especially in emerging economies, where the adoption of artificial lights is on the rise.

Restraints

Despite the positive momentum, the Artificial Lights Market faces certain restraints that impede its growth. One such challenge is the initial cost associated with adopting advanced lighting solutions. While LED and smart lighting systems offer long-term savings, the upfront investment can be a barrier for some consumers and businesses, particularly in regions with economic constraints.

Interoperability issues and concerns about data security in smart lighting systems are additional challenges. The integration of IoT technology raises questions about privacy and cybersecurity, hindering the adoption of these advanced lighting solutions in some segments.

Market saturation in developed regions poses a restraint as well. In mature markets, where a significant portion of the population has already transitioned to energy-efficient lighting, the scope for further growth becomes limited. Manufacturers and service providers must explore new avenues and strategies to overcome this challenge.

Opportunities

The Artificial Lights Market presents several opportunities for growth and innovation. The ongoing development of smart city projects around the world creates a vast opportunity for the integration of intelligent lighting systems. Smart street lighting, in particular, is gaining traction as it not only enhances energy efficiency but also contributes to improved public safety.

The rise of e-commerce provides manufacturers with opportunities to expand their reach and tap into new markets. Online platforms enable companies to showcase and sell their products to a global audience, opening up avenues for international growth and partnerships.

Furthermore, the increasing focus on human-centric lighting design presents an opportunity for market players to differentiate their products. Artificial lights designed to mimic natural sunlight and support circadian rhythms are gaining popularity, especially in healthcare and office environments, where the impact on human well-being is a crucial consideration.

Read Also: Uterine Fibroid Treatment Devices Market Size, Share, Growth, Report by 2033

Artificial Lights Market Companies

- GE Lighting (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Panasonic Corporation (Japan)

- OSRAM Licht AG (Germany)

- Schneider Electric SE (France)

- Cree, Inc. (U.S.)

- CITIZEN ELECTRONICS CO., LTD. (Japan)

- Lumerica (Canada)

- Havells India Ltd. (India)

- LEDtronics, Inc. (U.S.)

- Patriot LED (U.S.)

- Acuity Brands, Inc. (U.S.)

Segments Covered in the Report

By Type

- LED

- CFL

- LFL

- HID

- Halogen

- Incandescent

By Application

- General Lighting

- Automotive Lighting

- Backlighting

- Others

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/